SBA Express Loans: What Are They and How to Apply

The SBA offers numerous lending options for small business owners — backing anywhere from 50% to 90% of the loan. One lesser-known loan option is the SBA Express loan, which is easier to apply for — and faster — than the popular standard 7(a) loan. In this article, we explain what an SBA Express loan is, how to qualify for one, and where to get one.

What is an SBA Express Loan?

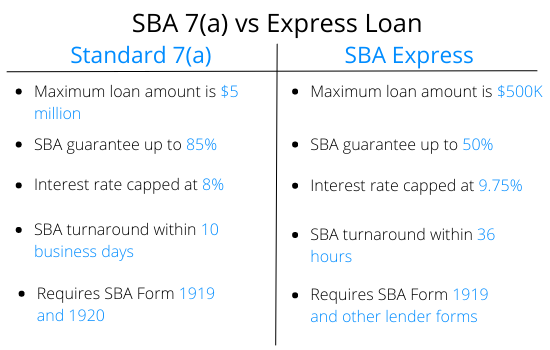

An SBA Express loan is a small business loan that is backed by the government — specifically the SBA. It falls under the 7(a) loan group, but is designed specifically for accelerated SBA review — the SBA will review the application within 36 hours. While the Express loan is part of the 7(a) loan group there are some notable differences.

The loan amount for an Express loan is capped at $500K, while the standard 7(a) is capped at $5 million. The SBA guarantees up to 50% of the loan amount for an Express loan and guarantees up to 85% for the standard 7(a). The SBA reviews Express loans within 36 hours as opposed to 5-10 business days for 7(a). Lastly, the interest rate of Express loans can creep up to 9.75% while the standard 7(a) is capped at 8%.

The Express loan is designed to be faster and easier than the standard 7(a), but even though the SBA turnaround time is 36 hours, that does not mean you will receive the funds in a matter of days. Depending on the processing time of the SBA lender you use, it can take up to two months to receive your loan — but many establishments can process your loan in under 30 days.

How Do I Qualify for an SBA Express Loan?

To qualify for an SBA Express loan, you must meet the following requirements:

- Have a for-profit small business as defined by the SBA.

- Operate in the U.S.

- Have reasonable owner equity to invest

- You have invested other financial resources — including personal assets — into the business

Aside from the SBA's requirements, you will need to meet your lender's requirements as well. These requirements will vary, but you will need to be prepared to offer some kind of collateral for loans over $25K. Additionally, some lenders will require a FICO score of at least 650-680, some even as high as 720, positive cash flow and annual revenue, and may require a certain amount of time in business.

What are the Pros and Cons of an SBA Express Loan?

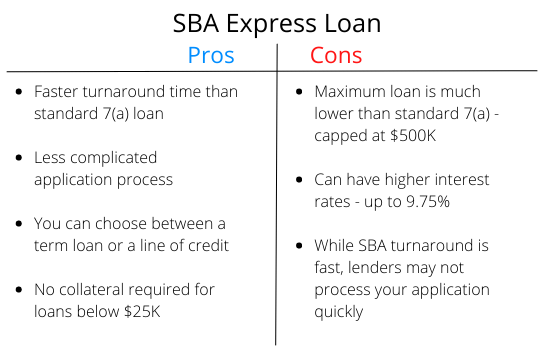

There are several advantages to the SBA Express loan. One of the biggest advantages is the speed at which the SBA processes your loan. Rather than waiting up to 10 business days for the SBA to review your application, your lender will have an answer within 36 hours. The caveat is, you're still subject to the speed at which your lender processes their part of the application — which can still stake up to 30 days or more.

Additionally, the SBA Express loan is easier to apply for than a standard 7(a) loan — there's less paperwork involved. One final benefit is not having to put up collateral for loans below $25K, which is standard for the 7(a) loan group.

How Do I Apply for an SBA Express Loan?

To get an SBA Express loan, you have to go through an SBA-approved lender. Due to that fact, the application process will vary depending on lender specifications and requirements. Here is a general process for you to follow when obtaining an SBA Express loan.

1. Determine your loan amount. Before embarking on this financing journey, it's critical to understand the amount you will need. Be as accurate as possible when determining the amount of capital you require. Bear in mind that Express loans are capped at $500K.

2. Find a lender. SBA Express loans are issued through financial institutions like banks, credit unions, and other lenders. To find an SBA-approved lender, use the SBA lender match tool online.

3. Double-check your eligibility. The SBA's requirements are listed above, but be sure that you check with your lender to determine if you meet their requirements as well — such as time in business and minimum credit score.

4. Complete SBA Form 1919. SBA Form 1919 is the form that the SBA requires from all borrowers. You will also have to complete the forms required by your lender and attach supporting documentation.

Get Funding Help for Your Business

Do you need help getting funding for your business? We can help determine your best option. We can help with SBA loans and lines of credit, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.