Owner's Draw vs. Salary: How to Pay Yourself as a Business Owner

Every business owner needs to bring home a paycheck, but it can be difficult to understand your options and choose the best approach–especially if you are a new business owner.

There are two main ways you can pay yourself as an owner: an owner's draw and taking a salary. In this article, we discuss the differences between these two methods, highlight the main considerations to bear in mind, and point out mistakes to avoid when paying yourself.

Difference Between Owner's Draw and Salary

While there are other ways business owners pay themselves, an owner's draw (or, a draw) and taking a salary are the two most common. Here is a definition of each method.

- Owner's draw: An owner's draw simply means that you draw money, either cash or means, from your business' profits on an as-needed basis. There is no regular amount or schedule that you adhere to. When you need money, you draw from business funds. This is more common with the self-employed that don't have employees.

- Salary: A salary is just like a typical paycheck that you received as an employee of another business. It's a set amount of money that you pay yourself regularly. You and your accountant first determine what reasonable compensation is for your position and industry, and then you give yourself a set weekly, bi-weekly, or monthly paycheck.

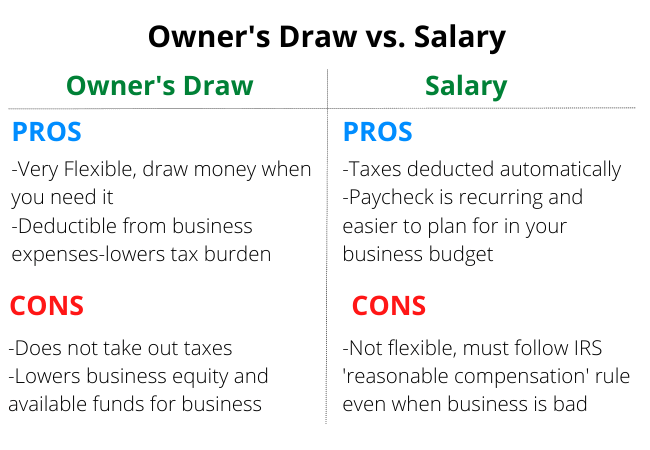

Pros and Cons of Owner's Draw and Salary

There are positive and negative aspects to both of these methods. An owner's draw is very flexible. Also, you can deduct your pay from business profits as an expense, which lowers your tax burden. However, it can reduce the business's equity and available funds, and you must account for self-employment taxes.

A salary is less flexible, but it already deducts taxes and it's a stable recurring expense to account for in your business budget.

How to Choose Between an Owner's Draw and a Salary

Many factors will impact your decision to choose a draw or salary. Three factors to be aware of are your business entity or structure, your owner's equity, and tax implications.

Consider Your Business Structure

Your business structure is the single biggest determining factor when it comes to choosing between an owner's draw and a salary. Generally speaking, you can only take an owner's draw if you have a sole proprietorship, partnership, or LLC. You can take a salary if you have a corporation or an LLC taxed as a corporation.

Understand Owner's Equity

Owner's equity is typically defined as the amount of money that would be returned to the owner (after all liabilities are paid) if the business is liquidated. Your equity comes from what you invest into the company–such as personal finances, equipment purchases, etc, plus business earnings.

If you decide to take an owner's draw, you cannot exceed your total equity. This is especially important if have partners, as taking too large of a draw can dip into your partner's equity–and salary.

Tax Implications

Do you want to account for income tax yourself or have it already taken out? If you elect to take a draw, you will need to set aside money yourself to pay self-employment tax. Many owners pay estimated tax quarterly to avoid penalties come tax season.

If you do not want to worry about taxes as much, paying yourself a salary with accounting software is a good way to go. This way, you get a consistent paycheck and your accountant (or software) can withhold your taxes. If you pay payroll tax, consider taking a salary so your accountant/software can track everyone's taxes in one place.

How Much You Should Pay Yourself

After you choose your payment method, it's time to calculate the amount. How much you pay yourself will depend on numerous factors, such as your location and business industry. At the very least, your pay should cover all of your financial obligations–rent/mortgage, car loan and payment, savings, etc.

If you choose to take a salary, consult with your bookkeeper to ensure it is in line with reasonable compensation for your industry and position. No matter if you choose a draw or salary–or a combination of both– ensure that you pay yourself fairly and what your business can afford.

Avoid These Mistakes While Paying Yourself

As you pay yourself, there are a few mistakes that can complicate your life that you want to avoid. These mistakes include mixing personal and business finances, not budgeting for taxes, and paying yourself inconsistently.

- Mixing personal and business finances: It's best practice to keep personal and business accounts separate. Using the same bank account for personal expenses and business expenses is going to complicate your bookkeeping and could lead to you losing liability protection if you have an LLC or corporation. Open a business bank account and conduct all business transactions through it.

- Not budgeting for taxes: If you decide to take a draw, it is important to set aside a portion for taxes. Not doing so will result in a large tax bill come tax season. You may also have to pay penalties if you do not pay taxes quarterly.

- Paying Yourself Inconsistently: Not paying yourself at a consistent pace makes it difficult to correctly budget for your pay. Having a consistent pay schedule also look better to lenders when it comes time to apply for a loan.

Get Help with Business Funding

Do you have other questions about your business, such as EIDL applications, SBA loans, or other business funding questions? Get ongoing personalized funding help from our team. There are over 3,500 on our waiting list, but you can skip the waitlist completely with this invite link. Join Skip Premium today and get 1-1 support.