Best Loans for Women-Owned Businesses in 2022

If you’re a women-owned business in search of additional funding, there are financing resources available just for you. In this article, we’ll outline the best places for women-owned business to search for capital within the SBA, covering the 7(a) and Microloan programs, and other financing resources including term loans, lines of credit, and merchant cash advances from our online banking partners.

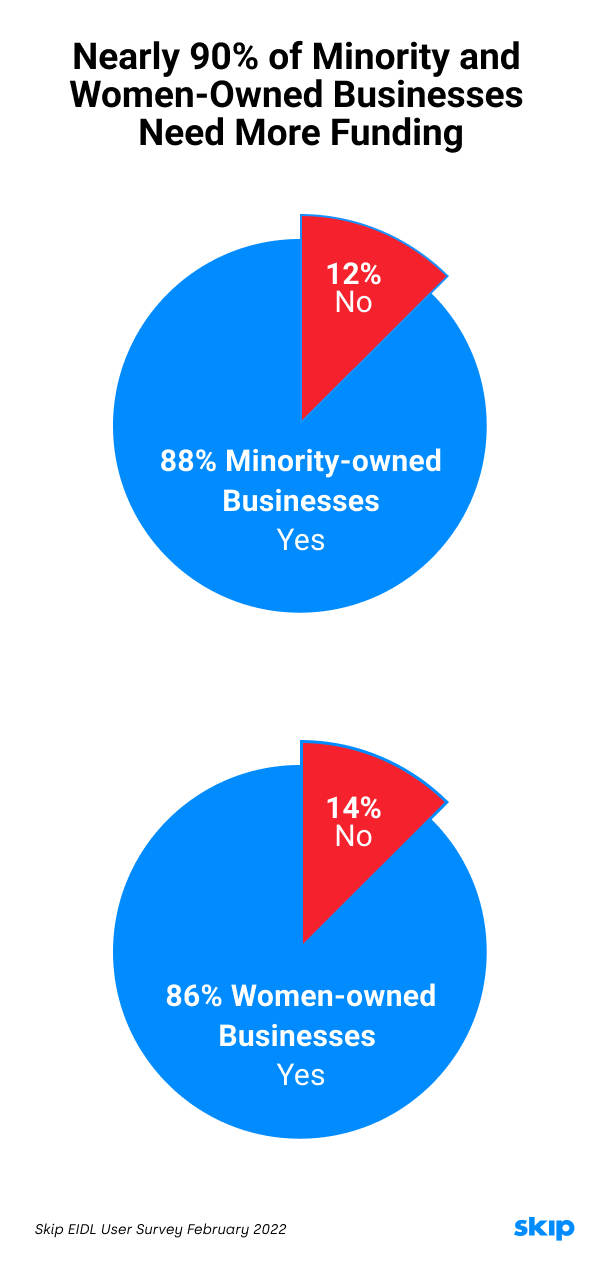

Nearly 90% of Minority- and Women-Owned Businesses Need More Funding

Recently, Skip surveyed EIDL recipients to identify the impact it had on small businesses. Surprisingly, 60% of businesses reported that they would be out of business today if they did not receive funding from the SBA's Economic Injury Disaster Loan (EIDL) program.

Of all the respondents, nearly 90% of minority-owned or women-owned businesses receiving EIDL funding stated they needed more capital.

Small Business Administration (SBA) Business Loans

The SBA is always a great place to look for funding opportunities. The two most common types of SBA loans are the 7(a) and Microloan programs.

Eligibility. To be eligible for either of the following, you must be a small business according to the SBA’s size and requirements standard. Additionally, to qualify as a women-owned business, yours must:

- Be at least 51% owned and controlled by women who are U.S. citizens

- Women must hold senior leadership role(s) and proportionate stake(s) in the business

- Exhibit fiscal responsibility

- Women manage the day-to-day operations

- Women are involved in long-term business planning

SBA 7(a) Loans. The SBA 7(a) loan program is a partnership with lenders where the SBA guarantees up to 90% repayment of the loan should a small business default. The 7(a) loan program was designed to incentivize banks to offer greater access to capital for small, minority, and women-owned businesses — with lower interest rates and better repayments terms.

The 7(a) loan program differs from other small business loans because it’s secured with a down payment as collateral, like a home mortgage, designed to fill the gap for women-owned businesses in search of working capital for as little as $500 — or up to $5M.

How to Apply. If you meet the SBA’s eligibility requirements, your next steps are gathering all the necessary documentation for your application. Here is a list of documents your women-owned business will need to apply for an SBA 7(a):

- Borrower Information form (SBA Form 1919)

- Statement of Personal History (SBA Form 912)

- Personal Financial Statement SBA Form 413

- Financial Statements

- Ownership and Affiliation

- Business License or Certificate

- Loan Application History

- Income Tax Returns

- Resumes of all Principles or owners

- Business Overview and History

- Business Lease Agreement

SBA Microloans. For qualifying women-owned businesses, the SBA Microloan program provides a terrific option for startups or entrepreneurs with a solid action plan for their business. SBA Microloans are also available for some non-profit childcare centers.

The Microloan program is designed to assist “micro-entrepreneurs,” with loans up to $50K through SBA-approved intermediaries located throughout each state. The SBA awards PRIME Loans to these intermediaries at discounted rates, and empowered to make decisions on funding and setting the terms of your loan.

There may be more than one SBA Microloan resource in your state, region, or demographic. To apply for an SBA Microloan, find a local SBA-approved intermediary in your state.

Merchant Cash Advance (MCA)

A merchant cash advance is paid in a lump sum to use for whatever your business might need. They differ from other small business loans, or term loans, in that their repayment schedule is based upon a percentage of monthly credit card earnings.

This is great news for women entrepreneurs just starting their businesses with unsteady cash flow. The downside — such easy access to immediate working capital makes MCAs more expensive than other types of small business loans, add-risk, and only offer a short-term solution.

Online bank, and Skip funding partner, Fora Financial, offer MCAs that are especially advantageous for restaurants, or hospitality industry businesses — who experience predictable slow seasons.

Small Business Term Loans

A term loan can be as short as 12 months or as long as 25 years. Like a mortgage, term loans operate on structured repayment timelines and amounts and often provide better borrowing terms. A borrower receives a lump sum, paid back with interest via fixed monthly payments over a fixed loan term.

Funding Circle. Skip's other online banking partner, Funding Circle, specializes in financing start-ups with business lines of credits, SBA loans, as well as Merchant Cash Advances. Funding Circle offers flexible term lengths from six months — to 10 years. Borrow between $20-50K, and get approved in as little 24 hours, with funds delivered the next day, in some circumstances.

Although small business term loans have a structured repayment schedule, which may be inconvenient for business owners not generating consistent cash flow in their company’s infancy, they are still the preferred option for many small businesses, because of the potential growth benefits that come along with this type of investment in your business.

Small Business Line of Credit

A small business line of credit is designed to help meet the immediate needs of a business’s day-to-day operations and provides periodic access to a set amount of cash. Small business lines of credit are best for businesses who need fast cash, but who can also re-pay their line of credit quickly.

A line of credit is like a credit card — with better terms. You only pay interest on borrowed money. A small business line of credit allows you to re-borrow any repaid portion, up to your credit limit and until the draw period (loan repayment terms) concludes.

Blue Vine. Skip’s online banking partner, BlueVine offers two lines of credit from $5K up to $450K depending on how long your business has been operating.

To qualify for Blue Vine's 6-month line of credit you will need a FICO score of 600, be in operation for at least 6 months, and have $10K in monthly revenue. Their 12-month repayment business line of credits requires you to be in business for two years, show $450K in annual revenue, and a FICO score of 620.

FundBox. Skip’s other online lending partner, Fundbox, offers business lines of credit up to $150,000 with 12 or 24 weeks (3-6 months) terms. Rates start as low as 4.66% of the draw amount with approvals in as little as 24 hours — and next-day transfers.

Get Help for Your Business

Do you need help getting funding for your business? We can help you with crowdfunding registration, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.