Survey: 88% of Minority-Owned EIDL Recipients Need More Funding

Recently, Skip surveyed EIDL recipients to identify the impact it had on small businesses. Surprisingly, 60% of businesses reported that they would be out of business today if they did not receive funding from the SBA's Economic Injury Disaster Loan (EIDL) program.

After further review of the data, other interesting and telltale discoveries were made. One of the discoveries — 88% of minority-owned businesses that received EIDL funding still need more — a reality which is echoed by women-owned businesses as well. Here are more results from our study.

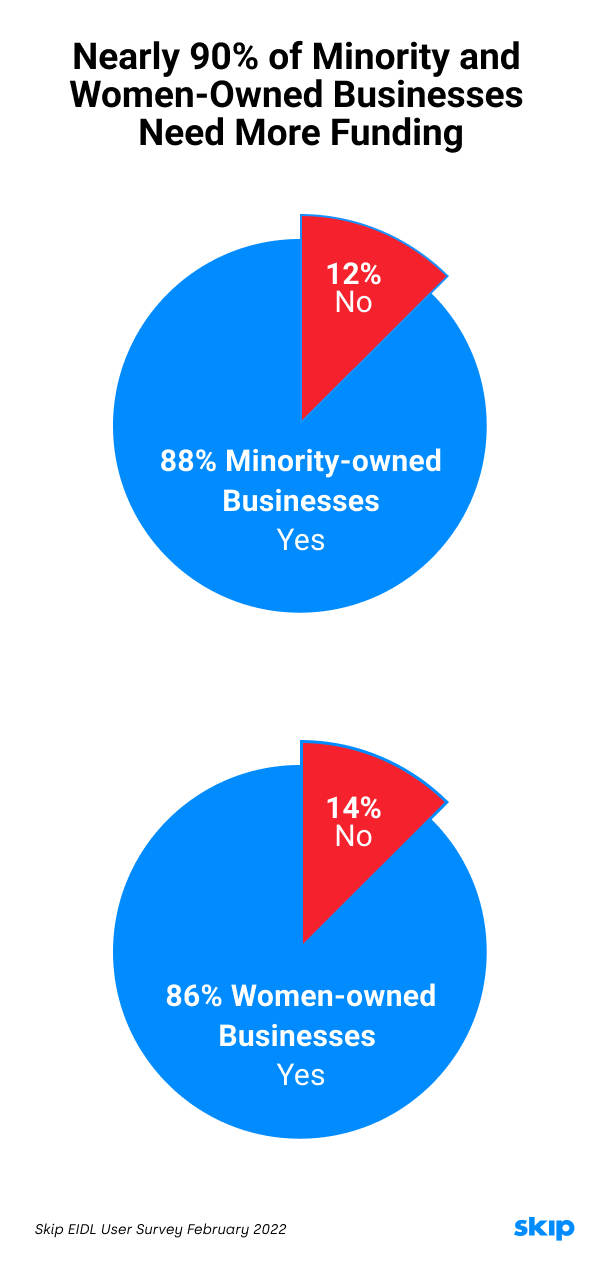

Nearly 90% of Minority and Women-Owned Businesses Need More Funding

Through the EIDL program, businesses can request up to $2M, but the amount businesses qualify for is based on several factors. Business revenue and cost of goods sold (COGS), personal and business credit, and sometimes cash-flow analyses are taken into consideration.

Respondents of the Skip EIDL Use Survey were asked if they were seeking additional funding. 88% of minority-owned businesses that received EIDL funding stated that they still need more capital. 86% of women-owned businesses that received EIDL funding need more funding as well.

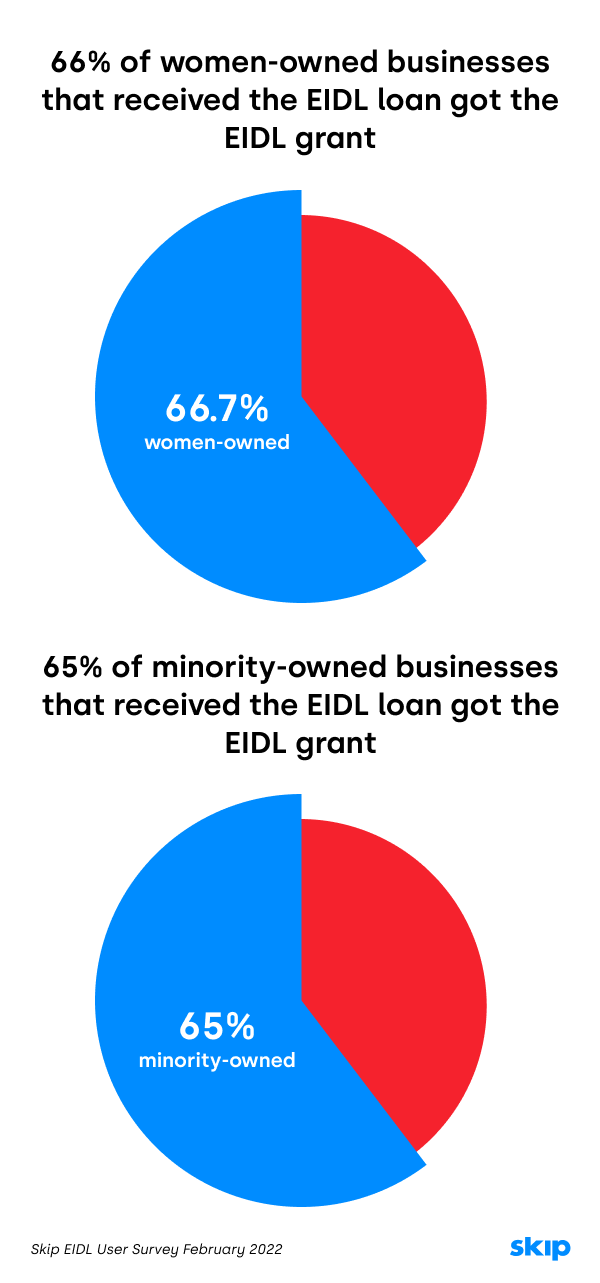

Two-Thirds of Minority and Women-Owned Businesses Received the EIDL Targeted Grant

The Targeted Advance was a $10K grant that businesses could receive in addition to or instead of the EIDL loan. To qualify for the Targeted Advance, businesses must have had fewer than 300 employees, must have demonstrated a 30% reduction in revenue, and must have been located in a low-income area.

A majority of the women and minority-owned businesses that participated in the Skip survey were located in low-income areas. 66% of women-owned businesses that received the EIDL loan also got the EIDL grant. Additionally, 65% of minority-owned businesses that received the EIDL loan also got the EIDL grant.

Over 60% of Minority and Women-Owned Businesses that Received EIDL Would Have Closed Without It

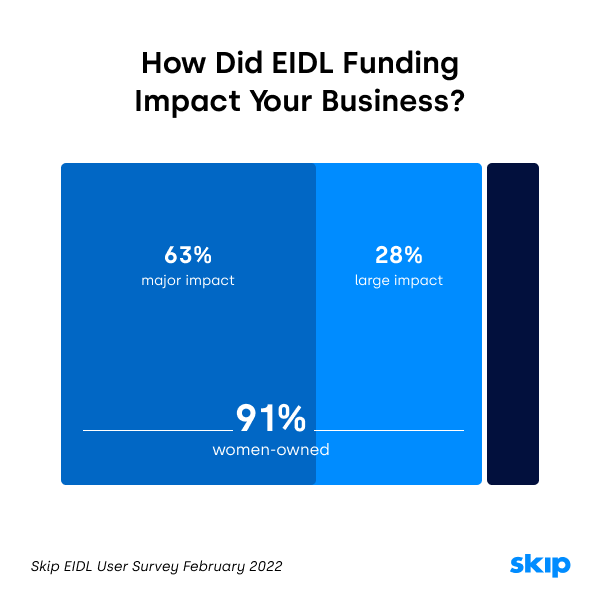

Respondents were asked to rate the impact of the EIDL program on their businesses, from major impact to low impact. Here are the definitions we used in the survey.

- Major impact. Would not be in business today without it [EIDL funds]

- Large impact. May or may not be in business today without it

- Moderate impact. Business would have been ok without it

- Low impact. I simply took advantage of the low-interest rate

91% of recipients that were women-owned stated that the EIDL program had a major or large impact on their business. Specifically, 63% stated that it had a major impact — they would be out of business today without EIDL funding.

28% stated that it had a large impact — they may or may not be in business today apart from EIDL funding.

Additionally, 92% of recipients that were minority-owned stated that the EIDL program had a major or large impact on their business. Specifically, 61% stated that it had a major impact on their business and 31% stated that it had a large impact on their business.

The main takeaway: 9 out of 10 women-owned and minority-owned businesses are at least doubtful that they would be in business today if they had not received EIDL funding.

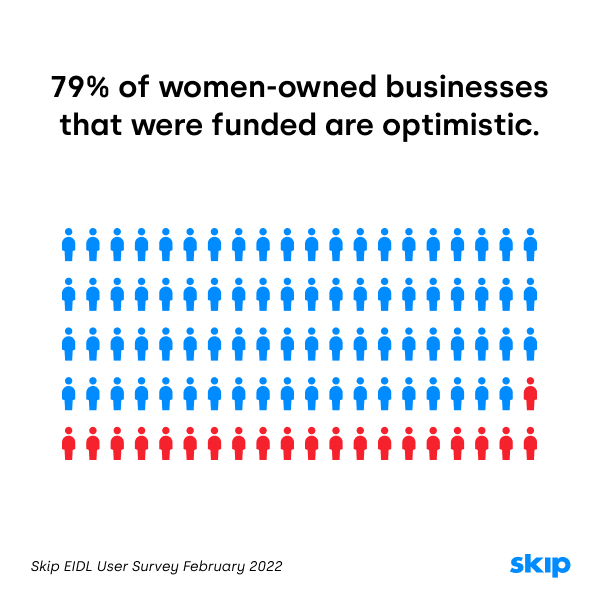

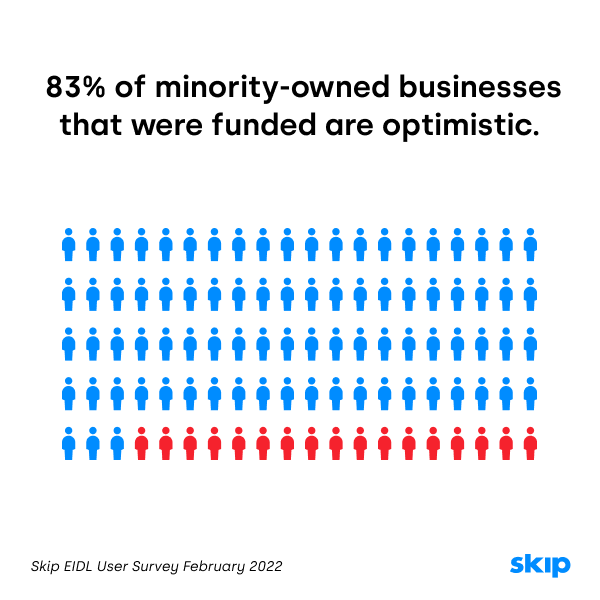

Most Minority and Women-Owned Businesses that Received EIDL are Optimistic About the Future

Business owners were asked if they were optimistic about the future of their business. Only 37% of women-owned businesses were optimistic about the future — including businesses that were funded and those that were not funded. Although, 79% of women-owned businesses that were funded are optimistic.

Minority-owned businesses followed the same pattern. Only 41% of minority owned-businesses overall are optimistic about the future, but 83% of minority-owned businesses that were funded are optimistic.

The data suggests a correlation between businesses receiving EIDL funding and outlook on the future of business. A majority of both women and minority-owned businesses that received funding were optimistic about the future.

Get EIDL and Other Funding Help for Your Business

Do you need help with your EIDL application or getting other funding for your business? We have helped small businesses collectively secure over $1B in funding. We can help you with EIDL, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.