How To Fill Out SBA Form 413: Personal Financial Statement

The Small Business Administration (SBA) requires form 413, the personal financial statement, for most SBA loans, such as the EIDL loan, 7(a) loan, and 504 loan. The SBA reviews your personal financial information to determine your ability to repay the requested loan.

In this article, we discuss how the SBA uses form 413, address frequent questions regarding the personal financial statement, and provide step-by-step instructions on how to apply.

How The SBA Uses the Personal Financial Statement

The SBA requires the personal financial statement (SBA form 413) because they use it to calculate your ability to repay the loan you are applying for. Many business owners were concerned about the inclusion of form 413 when the SBA rolled out EIDL 2.0, worried that personal assets would be used as collateral.

The SBA does not require it so they can place a lien on your personal assets, but to calculate your ability to repay.

Regarding the EIDL program, the SBA originally stated that the total potential amount a business could qualify for was based on their 2019 revenue and their cost of goods sold (COGS). We received exclusive information that SBA loan officers use a cash flow analysis to approve or deny EIDL loan applications (and likely other loan types as well). Form 413 is part of this calculation.

Personal Financial Statement FAQs

Here are some frequently asked questions regarding form 413.

Do all owners of a business need to fill out form 413? The short answer is yes. Every owner who owns 20% or more of the business needs to fill out form 413.

Will the SBA use my personal assets as collateral? It depends, the SBA does not take out liens on your personal assets for EIDL loans. For 7(a) loans and 504 loans, private financial institutions are included in the loan financing so personal assets may be used as collateral for those loans.

What documents do you need to fill out form 413? The documents you need to gather will vary, depending on what assets you have. Here is a quick list of documents to have on standby: personal bank account info, tax forms, retirement account info, life insurance documents, pay stubs or other salary documentation, mortgage statements, and paperwork on any other asset you own.

How To Fill Out the Personal Financial Statement

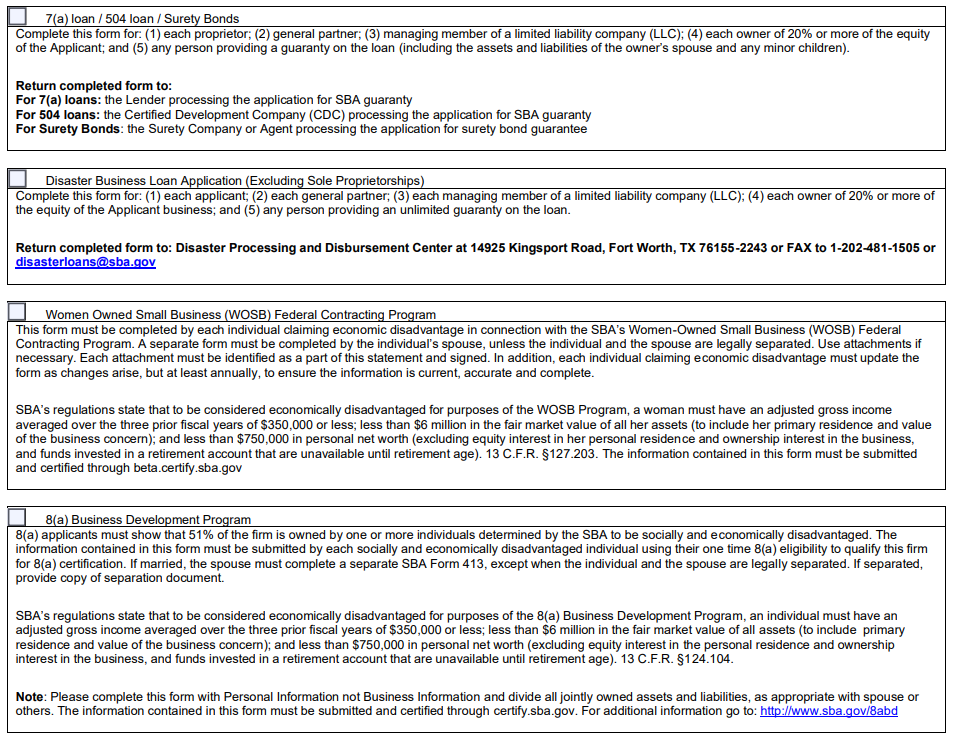

Step 1: Choose The Appropriate Program

Page one of the personal financial statement is simple. Check the box for the program you are applying for. If you are applying for the Covid EIDL program, select the second box, "Disaster Business Loan Application."

Disregard the notice that says excluding sole proprietorships, as the EIDL program is available for sole proprietors and independent contractors as well.

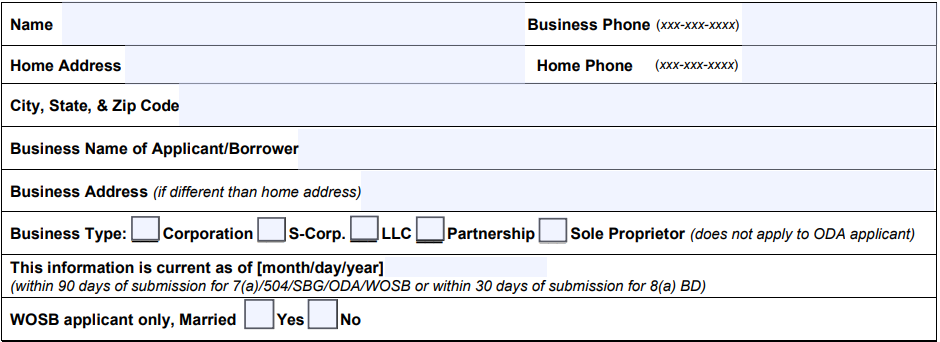

Step 2: Fill In Your Personal Information

The top box on page two asks for your personal information, such as your name, home address, and a few questions about the business. Remember, every owner or member that owns 20% or more of the company needs to complete SBA form 413.

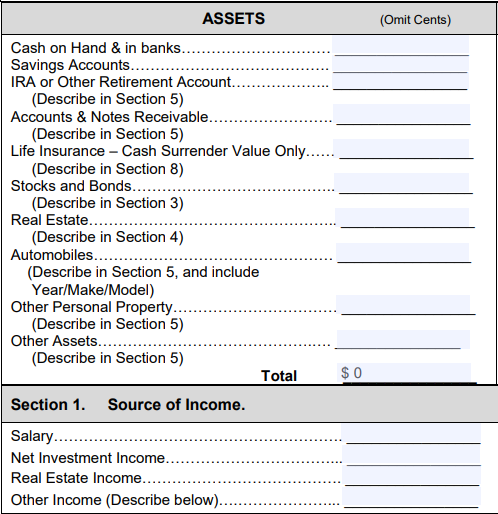

Step 3: Write Down Your Assets

This section may take you some time, depending on many assets you have. If you are married, you need to include the value of your spouse's assets as well. Here is a quick explanation.

- Cash on hand & Savings: Record what you and your spouse (if applicable) have in checking, savings, money market, and CD accounts.

- Retirement Accounts: Mark down any money in your 401K, 403B, IRA, etc.

- Accounts & Notes Receivable: If anybody owes you money, write down the amount here.

- Life Insurance: Do not record the pay-out value of your life insurance (what beneficiaries would get upon your death), but what you would be paid should you terminate it. This generally applies to whole life insurance policies only.

- Stocks & Bonds: List any other investments you have aside from your retirement account.

- Real Estate: Indicate the value of any property you own.

- Automobiles: Record the fair market value of any vehicles you own. Kelly Blue Book is a place to begin looking up the value of your car.

- Other Assets and Personal Property: Anything else that you own that doesn't fall into the above category. If you could sell it for cash (even the equity in your business), include it here.

- Total: Add up the value of all your assets and write the number here (you will need this in a moment).

- Source of Income: Here is where you will enumerate your income and where it comes from. Net investment is any income from stock dividends.

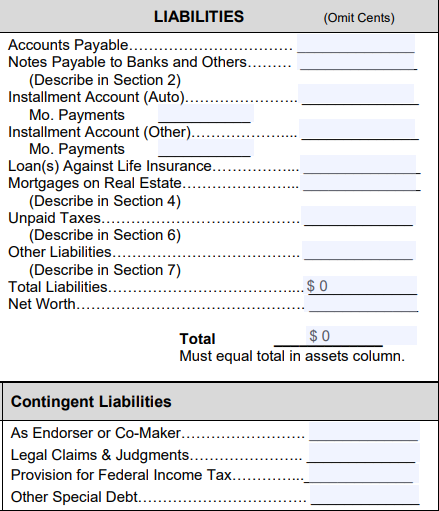

Step 4: Write Down Your Liabilities

Right next to the assets box is the liabilities section. Here is where you will record your personal liabilities and those of your spouse, if you have one. Here is a quick explanation.

- Accounts Payable: The amount of any unpaid bills (think utilities, cell phone, etc.) should be written down here.

- Notes payable to Banks: Any personal line of credit or credit card debt should be listed here.

- Installment Account (Auto): On the first line, record the total amount of your auto loan, followed by your monthly payments on the second line.

- Installment Account (Other): If you have a personal loan, account for that here, the total amount and monthly payment.

- Loan Against Life Insurance: Notate any loan you have where your whole life insurance is used as collateral.

- Mortgage: List the mortgage amount you owe on your house.

- Unpaid Taxes: Write down the amount of any unpaid taxes.

- Other Liabilities: Any other liability not listed above would go here.

- Total liabilities: Add up the amount of your liabilities (not the monthly amounts) and record the number here.

- Net Worth: To calculate this, subtract your total liabilities from your total asset value and write that number here. For example, if your total assets is $100K and your total liabilities is $55K, your net worth is $45K (100-55=45).

- Total: Add your total liabilities and your net worth. This number should be the same as your asset total. This may seem redundant, but it's there to ensure you don't make a calculation error.

- Contingent Liabilities: Notate if you are a co-signer or guarantor for another loan, if any legal filings are pending against you, money you're setting aside for future taxes, or any other liability not listed above.

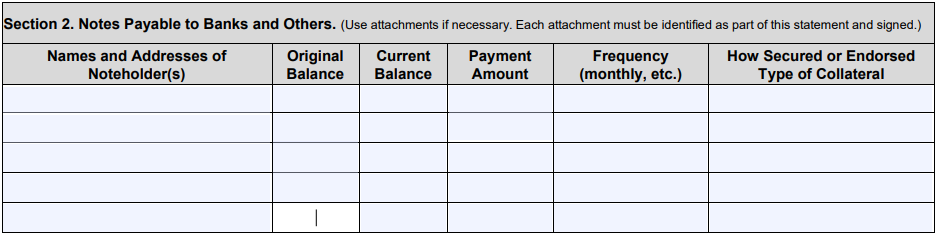

Step 5: Fill Out the Notes Payable to Banks and Others Section

In this section, you will provide further details on the banknotes you listed in the liabilities box. Include the name of the account holder, your balance, and other information regarding the balance. The original balance would be $0 for credit cards and lines of credit.

Step 6: Fill Out the Stocks and Bonds Section

Just like in the section above, section 3 (stocks and bonds) is the box where you will provide more information about this type of asset.

List the number of shares you have, the name, the original cost to you, the current value of one share, the date you determined that value, and the total value of that stock (value per share x number of shares you own).

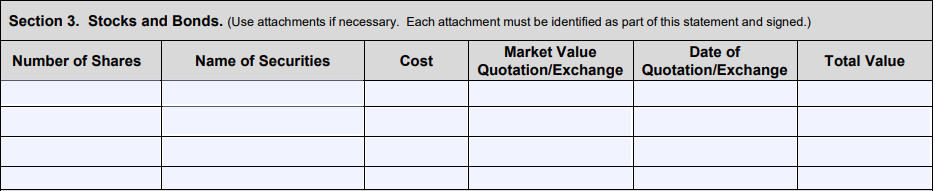

Step 7: Complete the Real Estate Owned Section

Section 4 is where you will provide more details about the real estate you own.

Record the type of residence, address, the date you bought the property, the purchase amount, the current market value, the mortgage holder, the mortgage account number, the remaining balance on your mortgage, the amount you pay monthly or annually, and the status (current, foreclosed, or paid in full).

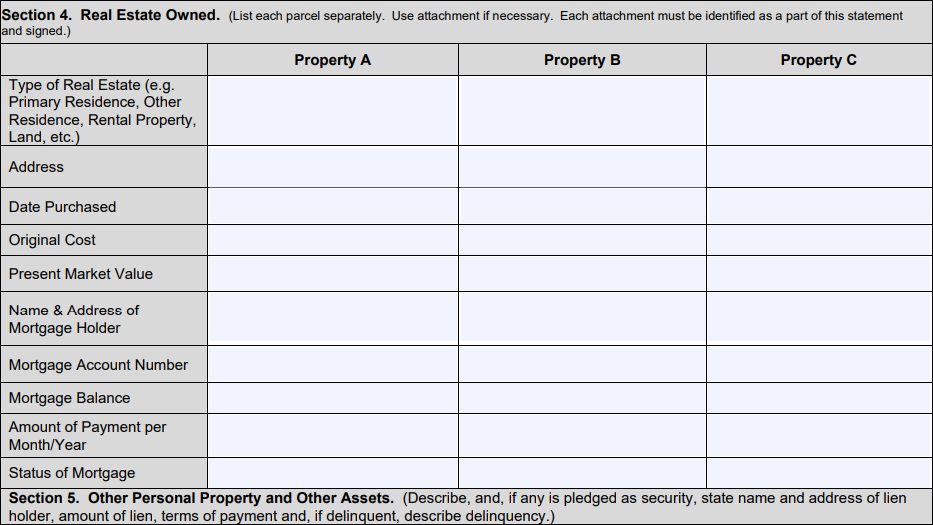

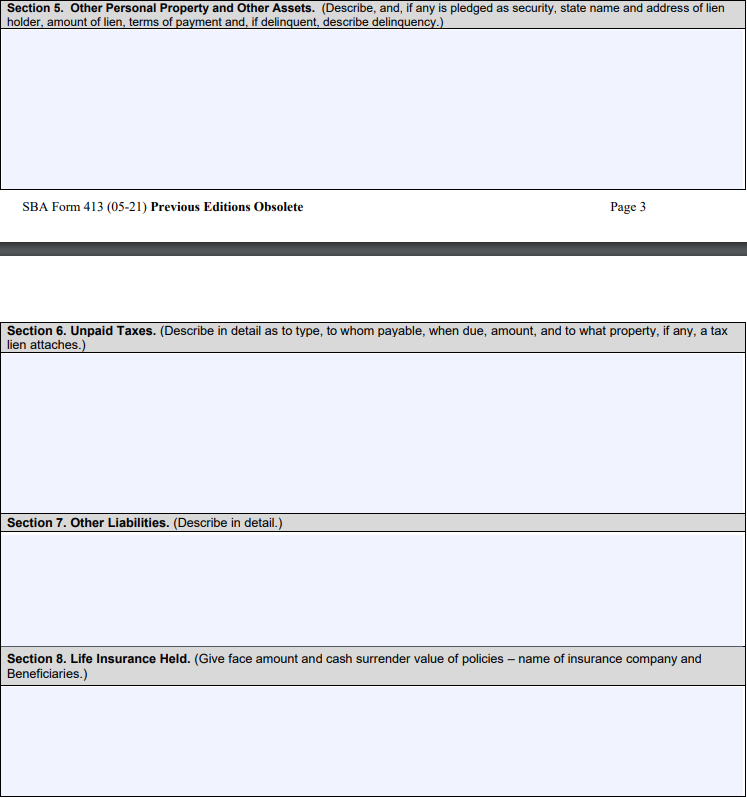

Step 8: Complete Section 5-8 on pages 3 and 4

Sections 5-8 are required to further explain the information you listed under assets. If these sections do not apply to you, simply write "N/A" in these boxes. If these do apply to you, ensure that provide the requested information for each section. The SBA wants to know the details of these assets and liabilities.

In section 5, list any other assets you have, if any lienholders are involved, and the approximate value of the assets. Do not intentionally overestimate or underestimate the value. Try to research and find an approximate value.

In section 6, list what type of tax is unpaid, who is payable (state, IRS, etc.), and the other requested information.

In section 7, list the details for any other liability who you. Include what it is, how much you owe, who you owe, when it's due, and how much you pay monthly.

In section 8, provide the details for your whole life insurance. If you have a term life insurance policy (5-year policy, 15-year policy, etc), you do not need to include it here unless there is a cash-out provision.

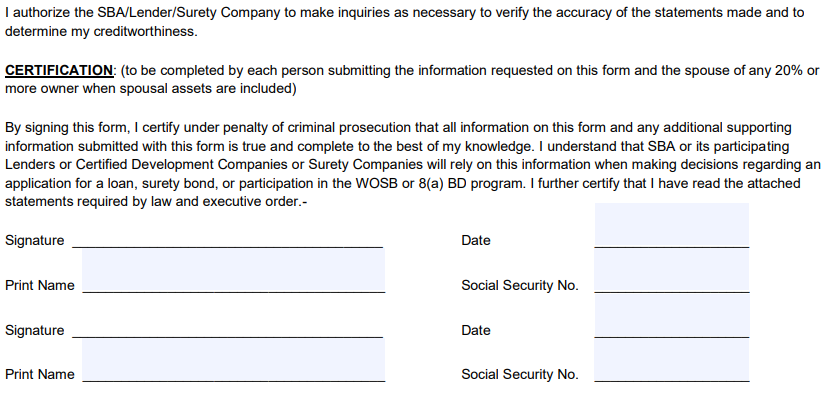

Step 9: Certify Your Application

The last step is to sign your SBA form 413. This certifies that you are not intentionally withholding any information and have filled out this form as accurately as possible, under penalty of civil prosecution. If you are married, both you and your spouse have to sign, date, and write down your SSNs.

Get Personalized Assistance

Want to get personalized assistance with your EIDL application or other business funding needs? Get ongoing personalized funding help from our team. There are over 4,500 on our waiting list, but you can skip the waitlist completely with this invite link and schedule a time to speak with someone form our team.