SBA Issues Updated EIDL Loan and EIDL Grant Information

The SBA has issued their most comprehensive guide to EIDL loans to date. This is a must-read for anyone who's received an EIDL loan, is thinking about it, has been denied or is interested in a loan increase. This is also a helpful guide to for the EIDL loan versus the EIDL Advance versus the Targeted EIDL Advance.

In this post we'll highlight some of the most important pieces of information in the new guidance. You can also watch the video below or read the full SBA EIDL Loan FAQ document here.

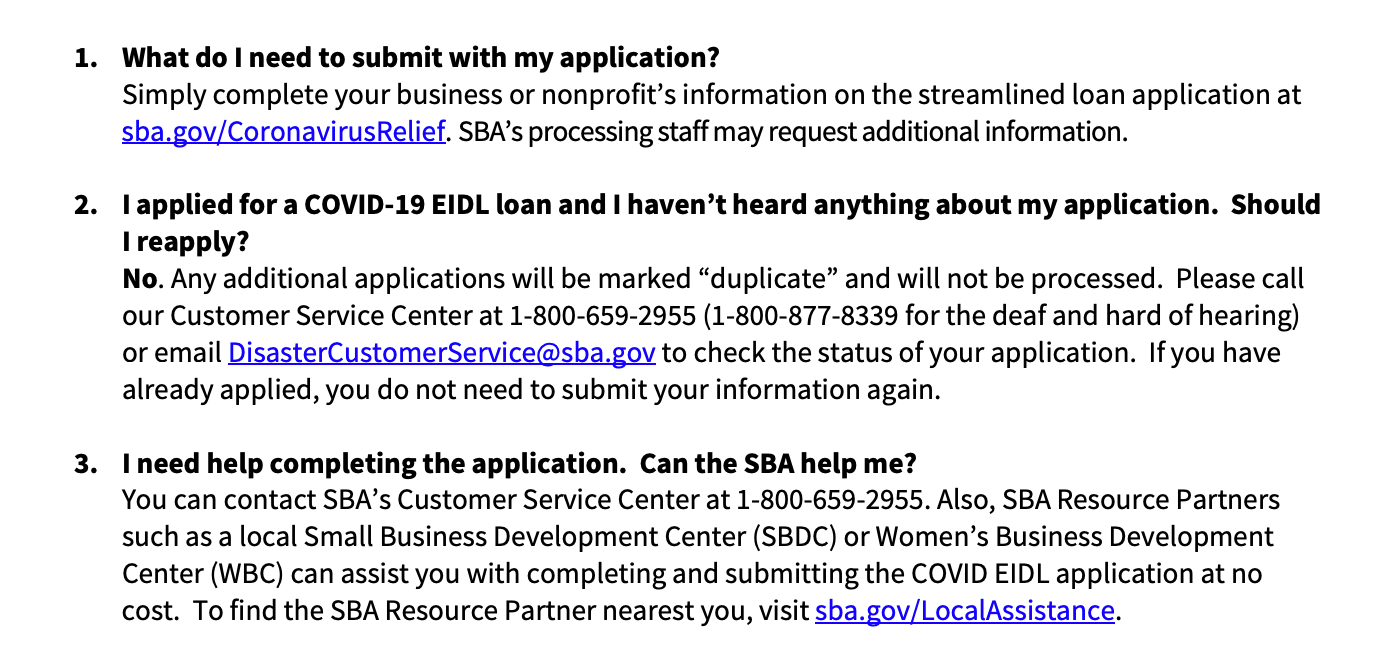

Applying for an EIDL Loan

If you want to apply for an EIDL loan, or you need help completing an EIDL application, here's some information below. To get the latest application information go to sba.gov/CoronavirusRelief

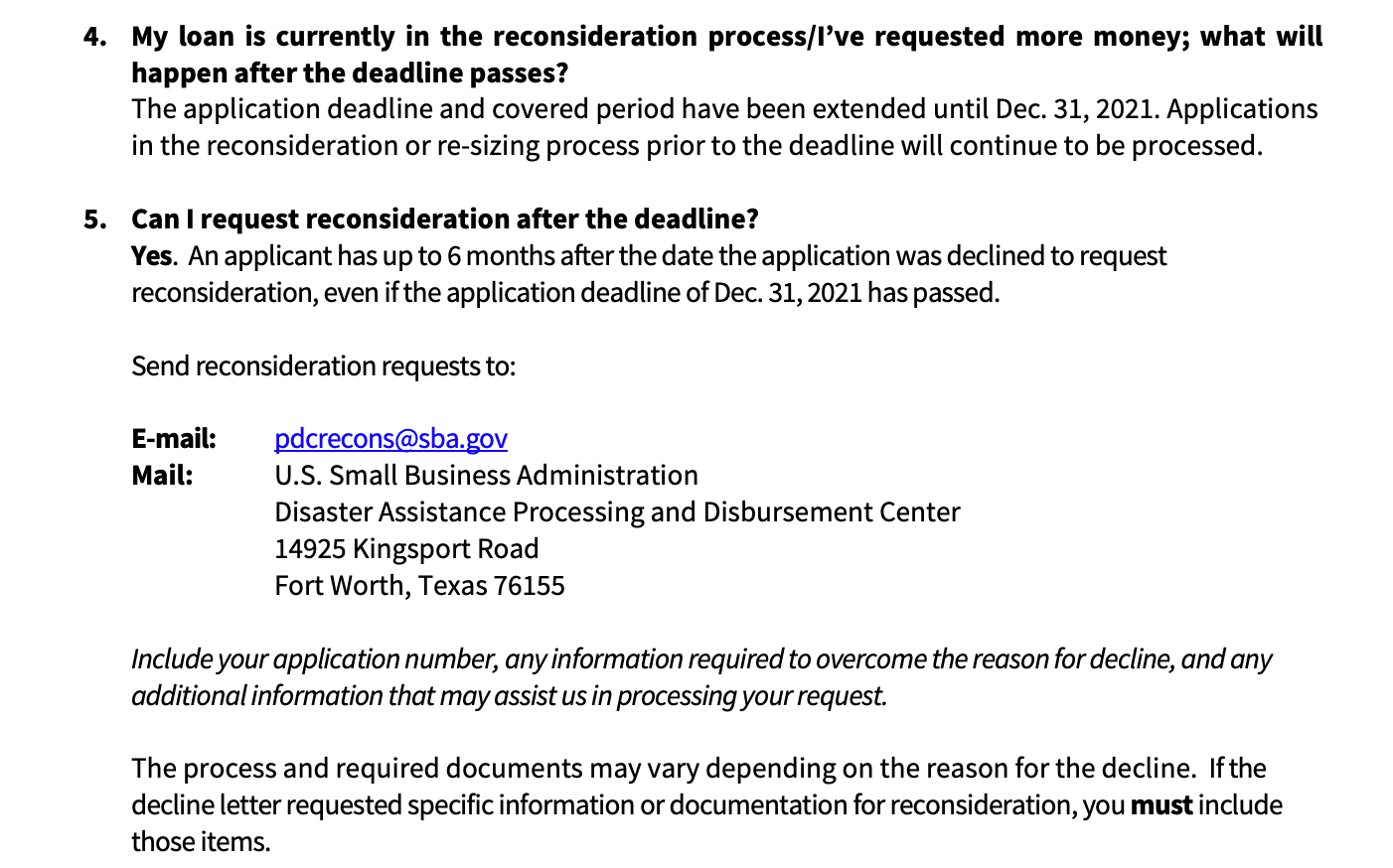

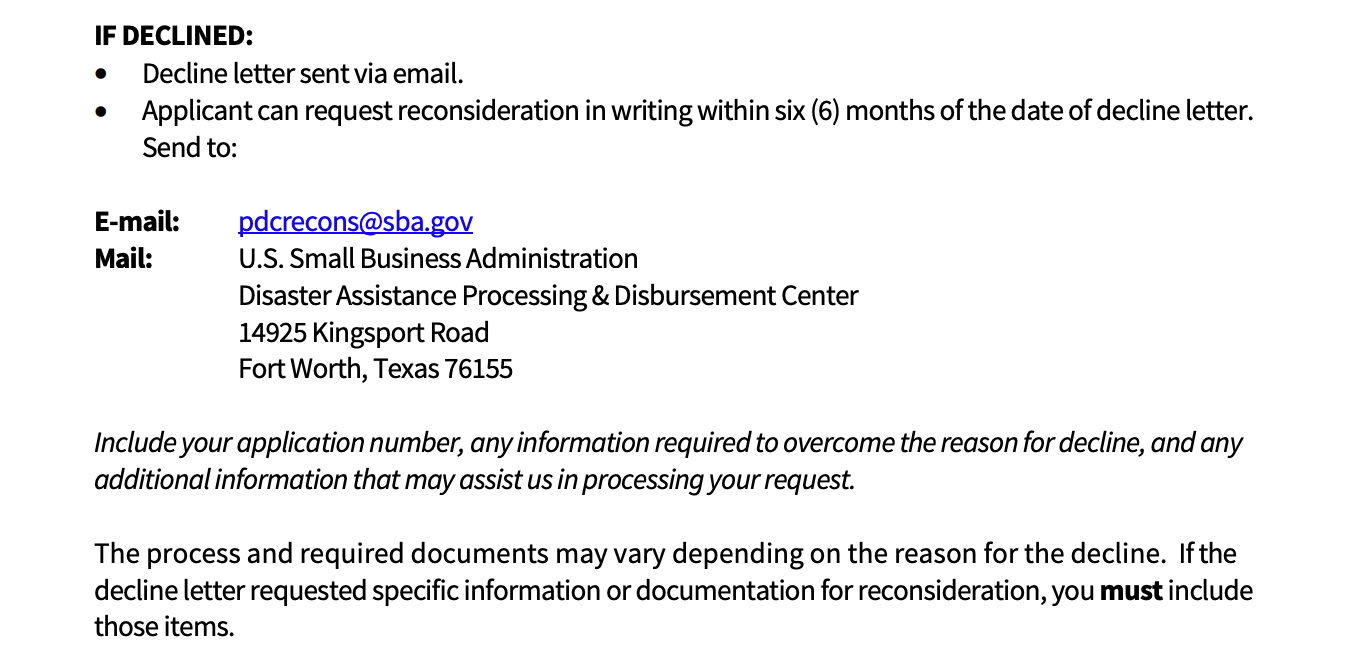

Getting Reconsideration for an EIDL Loan

If you've requested reconsideration for an EIDL loan, either for more funding or to appeal your EIDL loan decline, read below important instructions.

A key tip is to not apply again if you're still waiting. And further down on this post we have more information regarding requesting additional funding.

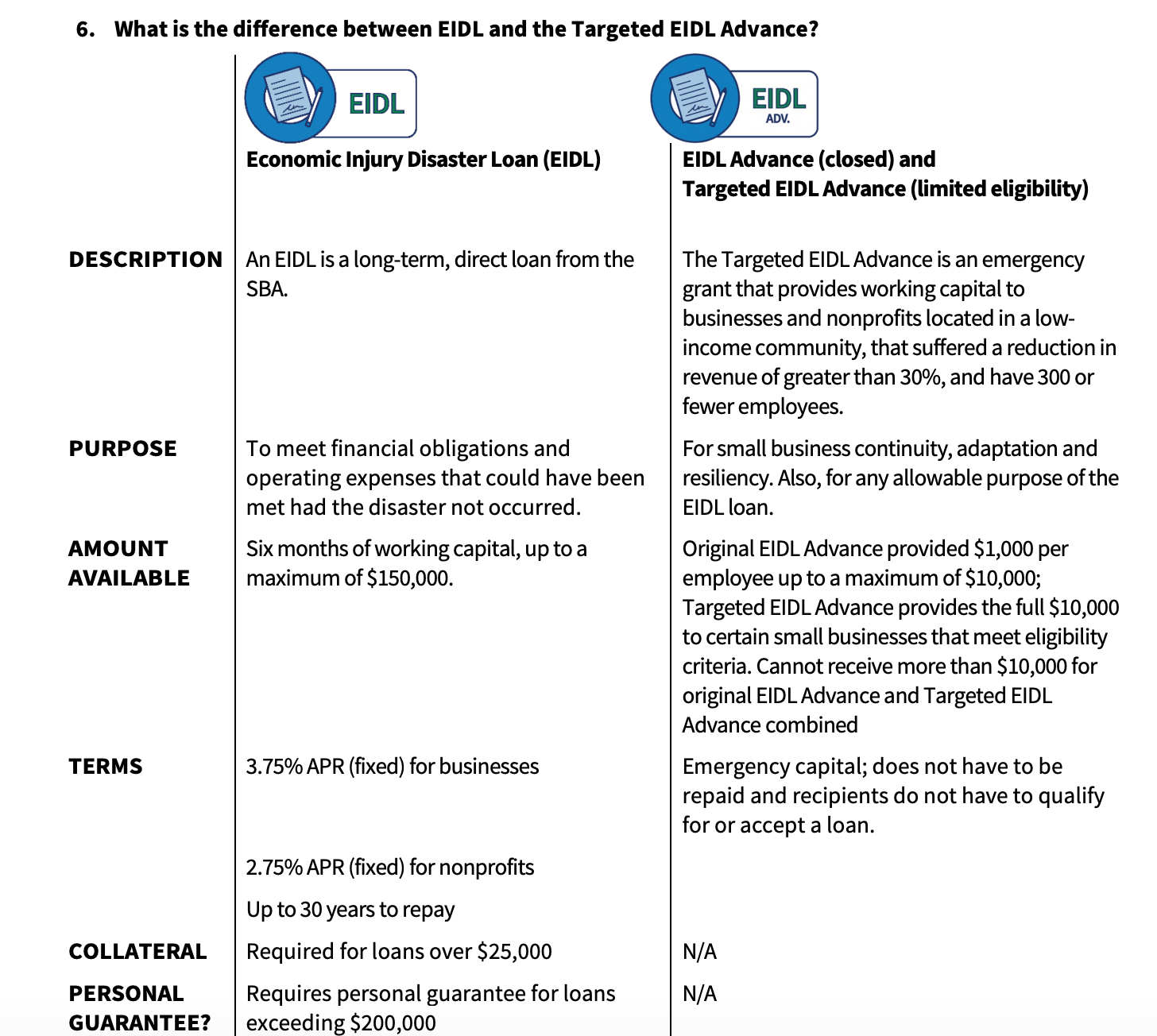

Differences Between EIDL Loan and Targeted EIDL Advance

If you're wondering about the differences between the EIDL loan and EIDL advances check out below.

If you want to see if you're eligible for a Targeted EIDL Grant, you can use the EIDL Grant tracker on the free Skip app to check status, for informational purposes only, and exact Targeted EIDL Grant amounts are up to the SBA.

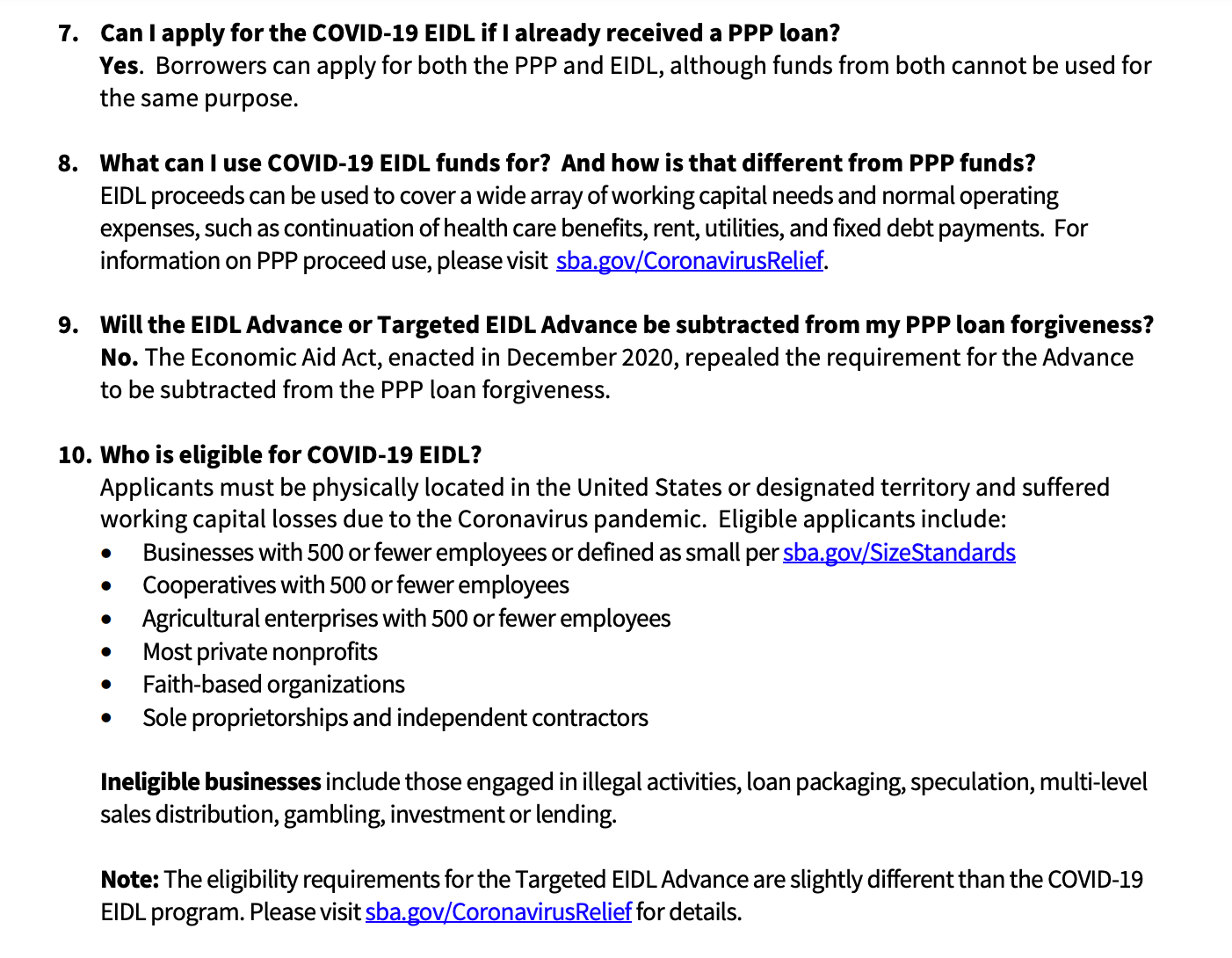

EIDL Loans Versus PPP Loans: Can You Get Both?

Yes you can get both. Below are the common questions and answers regarding the EIDL loan and PPP loan program.

Most notably, the PPP loan is forgivable, paid out through SBA-approved private lenders, and you do not have to deduct an EIDL Advance from a PPP loan amount.

If you want to apply for a PPP loan, you can consider applying via Bluevine or via Funding Circle or via Credibly. You do not need existing relationships with these lenders.

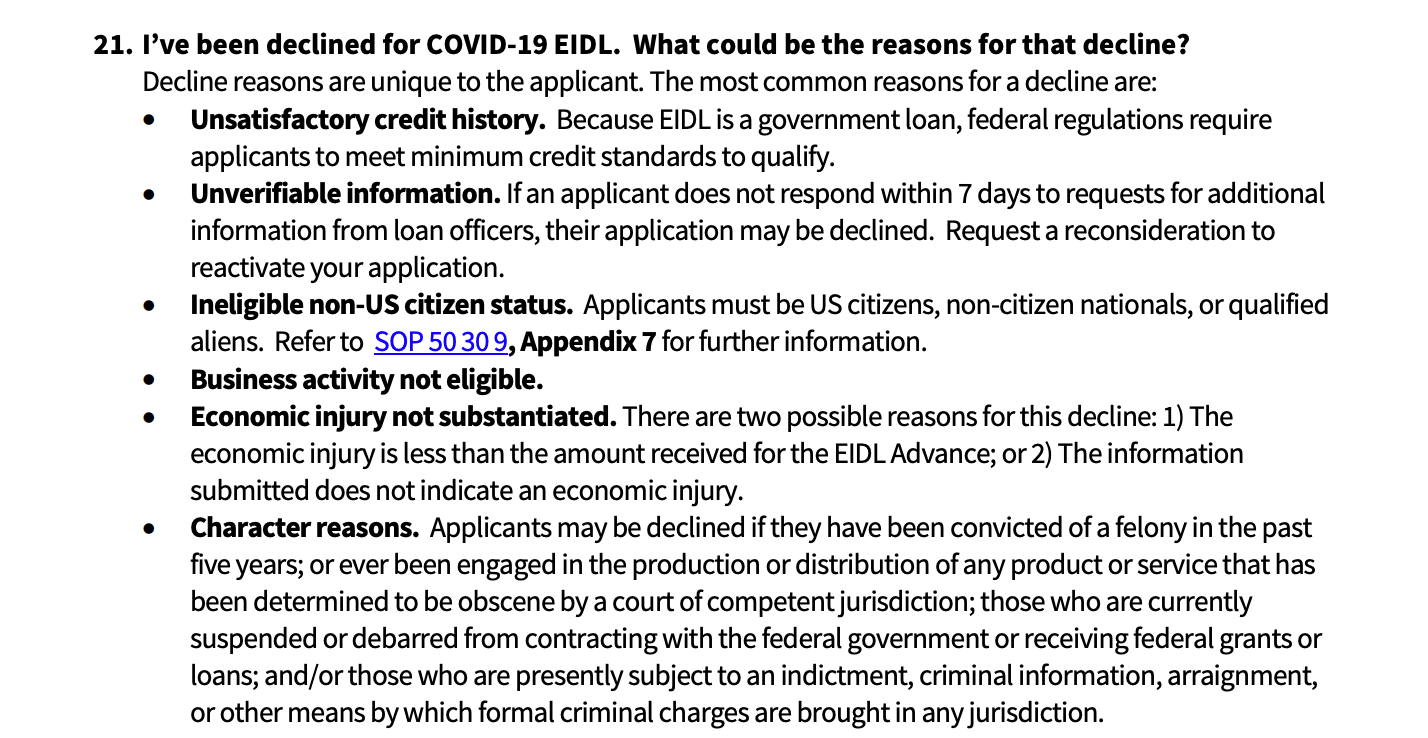

What If You're Declined for an EIDL Loan?

Below is information on how to contact the SBA to request reconsideration if you've been declined for an SBA loan.

Also, if you're curious about the common reasons why someone may be declined for an EIDL loan, here are the reasons.

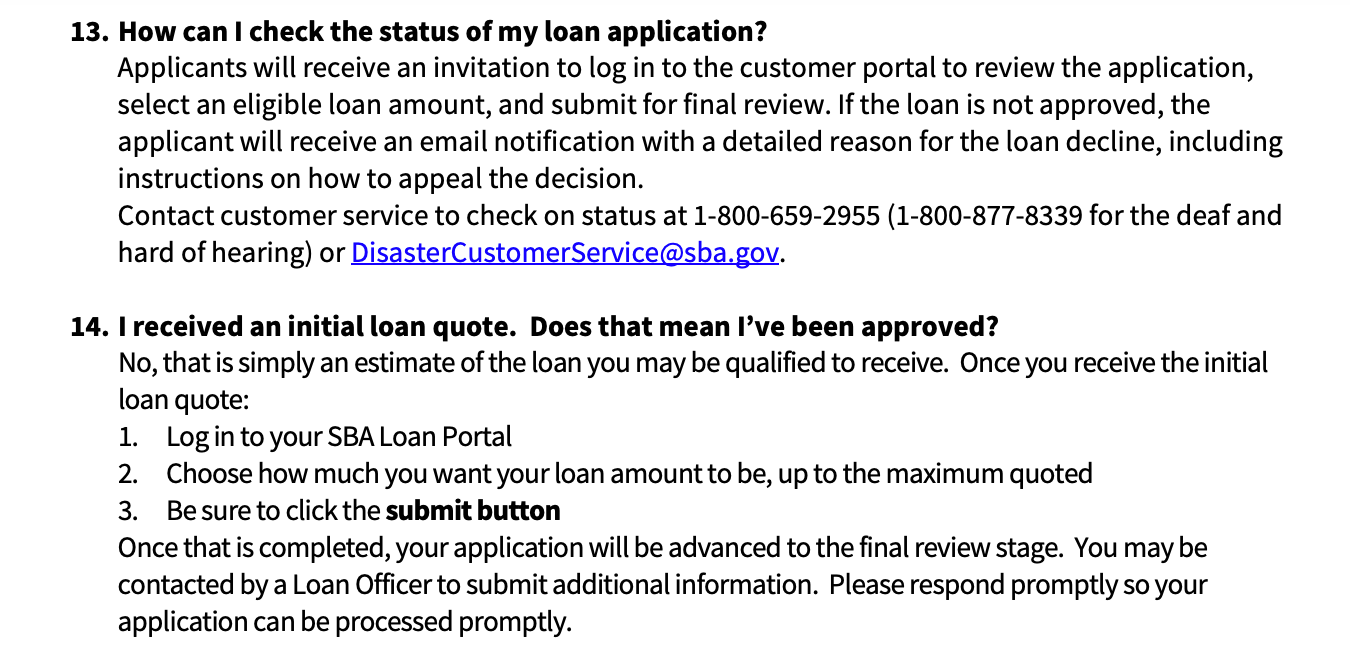

How Do I Check the Status of My EIDL Loan Application?

The SBA will contact you by email with updates. If you're invited to receive a loan you'll get an email with a login to a customer portal. You'll be able to see the EIDL loan amount being offered (this is not an approval) and you can see more information as well as select how much EIDL loan amount you're interested in.

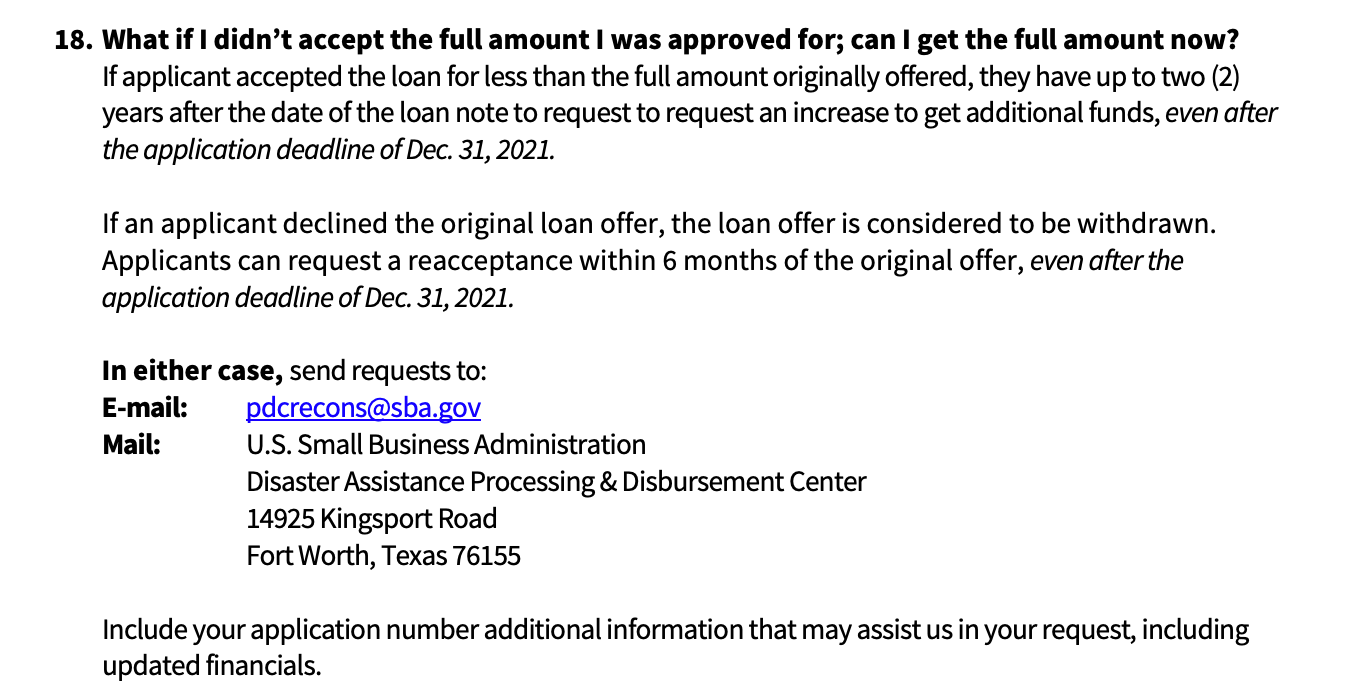

Can I Ask For an Increase of my EIDL Loan?

There are two common questions when it comes to increasing your EIDL loan amount.

First, if you accepted only part of your original offer, you can go back to the SBA (within 6 months of initial offer) to request an increase. Details are below.

Second, if you want to increase the money you've been approved for, you can do the same process. At the moment, you cannot get more than $150,000. So if you've already received the full $150,000, you cannot get additional SABA EIDL Loan funding. Exceptions here are if you have another business or you've been affected by another SBA-eligible disaster such as flooding or wildfires.

How Does EIDL Loan Repayments Work?

Some basics on making EIDL loan payments are below, including going to pay.gov to create an account and see your existing loan information. You'll need your original loan number among other information. We'll be covering this in a future video on our YouTube channel since it can be complicated.

What If I Can't Repay the EIDL Loan Yet Due to Shutdowns?

EIDL loan payments are deferred for 1 year. If you need longer deferment due to financial hardships, contact the SBA at DisasterCustomerService@sba.gov. More information on deferment is below.

EIDL Loan and EIDL Grant Summary

In short, we hope all of your pressing questions regarding EIDL loans have been answered above. We have left out a few questions but you can see the full SBA EIDL Loan FAQ here.

If you are curious about the Targeted EIDL Grant — if you qualify, if so for how much — you can take a look at our EIDL Grant Tracker on our app.

If you want to apply for a PPP loan, you can consider applying via Bluevine or via Funding Circle or via Credibly. You do not need existing relationships with these lenders.

Finally, if you want to keep up to date on all of this — and be the first to know about new city, state, and federal grant programs — get a free 15 days here of our Skip Plus.