Restaurant Revitalization Fund Recipients Shows the Stark Inequality of Relief Programs

Last week, the head of the U.S. Small Business Administration (SBA), Isabel Guzman, announced the closure of the Restaurant Revitalization Fund (RRF). The $28.6 billion fund, signed into law as part of the American Rescue Plan, aimed to provide much needed economic aid to restaurants, food, and beverage businesses. The funding was quickly depleted and hundreds of thousands of restaurant and food businesses were left with nothing. So what happened and why did the design of this program leave out so many well-deserving businesses?

📌 Want to see all RRF grant recipients? Use Skip's RRF recipient lookup to search by restaurant name, amount, or location.

Two-Thirds of RRF Eligible Applicants Received Zero Funding

As of June 30th, 2021, more than 278,000 eligible applications representing over $72.2 billion in requested funds had been submitted for the RRF program. Of those, only 101,000 applicants had their funding approved — an approval rate of 36%.

In addition, there were reports that many restaurants didn't even apply because early indications showed that after the initial 21 day priority period for woman-owned, minority-owned, and socially and economically disadvantaged businesses, funding might run out.

To the SBA's credit, there was a significant amount of outreach done prior to the opening of the application portal — via webinars, community partners, social media, and more — allowing people to prepare for the RRF "go live date." In fact, Skip also had a step-by-step guide to the RRF and a video watched by tens of thousands of business owners.

Despite this effort, there were two primary problems in the RRF funding design and roll-out that exacerbated the inequality of funding disbursements — funding limits and calculations and rescinded funding.

Thousands of Approved Restaurant Owners Had Their Funding Rescinded

The first major blow to the RRF roll-out occurred when approximately 3,000 approved applicants had their funding rescinded. These were all small business owners in the application priority group — women-owned and minority-owned business owners – that lost out on funding due to legal challenges to the priority selection process.

Following the lawsuits, according to Restaurant Business Online, "the SBA alerted 2,965 female and disadvantaged applicants via letter that they would not be getting their grants, even though they’d been informed earlier that they’d been approved and would soon be receiving the funds."

Dozens of comments on Reddit and YouTube, including on Skip's YouTube channel, showed the extent of this problem. Business owners believed their business's would receive this major influx of cash, then didn't.

The Real RRF Problem Started with the Design of the Program

According to FinancesOnline, "there are 1 million-plus restaurant locations in the US employing 15.6 million workers." According the National Restaurant Association, 9 in 10 restaurants have fewer than 50 employees and due to the pandemic, 110,000 restaurants reported having temporarily or permanently closed.

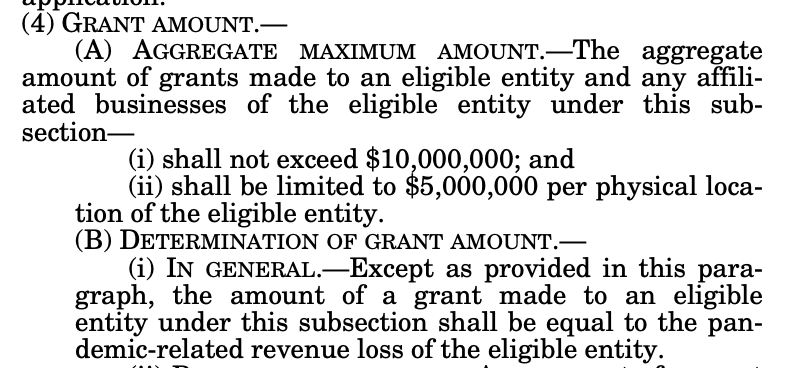

For the scope of this problem, Congress allocated $28.6 billion to one of the hardest hit industries with these primary guidelines:

- Restaurants and eligible food and beverage business would get grants that covered their 2020 revenue loss.

- Eligible businesses could received up to $10 million in grants.

In short, if a restaurant had $10M in revenue in 2019 and $5M in revenue in 2020 (and received, say, two PPP forgivable loans of $500,000 total) — the business would have been eligible for a $4.5M RRF grant.

Was the Congressional intent to help as many restaurants as possible weather the storm, or to help only a fraction of restaurants get funding? Assuming the former, a few different words in the Legislation could have helped hundreds of thousands of more restaurants get funding — and perhaps survive.

Here's Who Received RRF Funding (RRF Recipients)

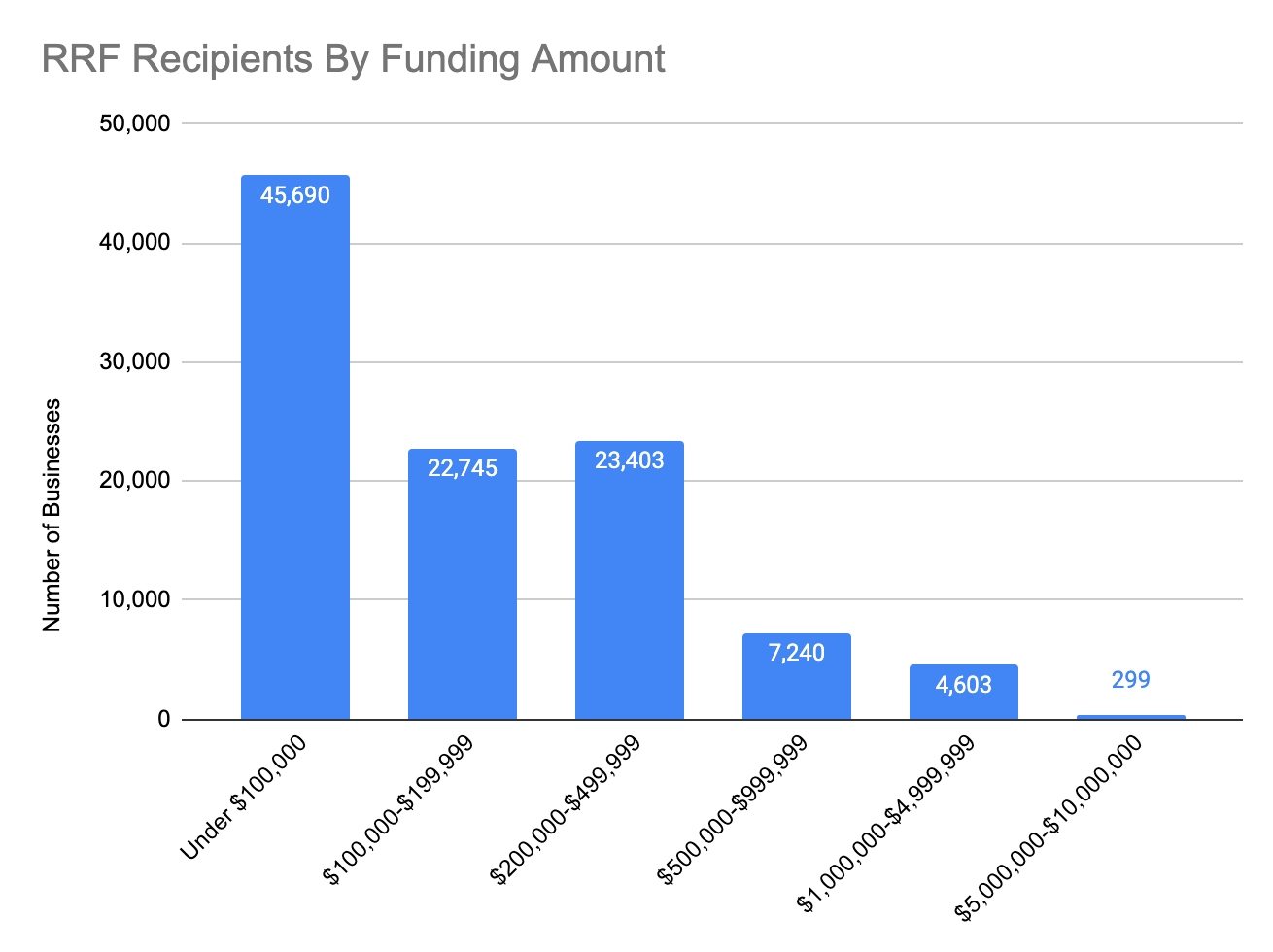

Here's how the size of grants was distributed by number of businesses. As expected, the majority of businesses received relatively smaller grant amounts. (But remember, their entire 2019 revenue decline was covered by these grants minus any PPP funding).

- 45% of businesses funded through the RRF received less than $100K accounting for 8% of total funding

- 66% of businesses funded through the RRF received less than $200K accounting for 19% of total funding

- 5% of businesses funded received over $1 million, accounting for 37% of total funding

The third point above — that nearly 40% of the funding went to 5% of recipients — points to the inequality in the program, if the desired intent of the relief funding was to help as many small food and restaurant businesses as possible. What could have happened if the RRF grant cap was lower? What could have happened if the grant covered only partial revenue decline?

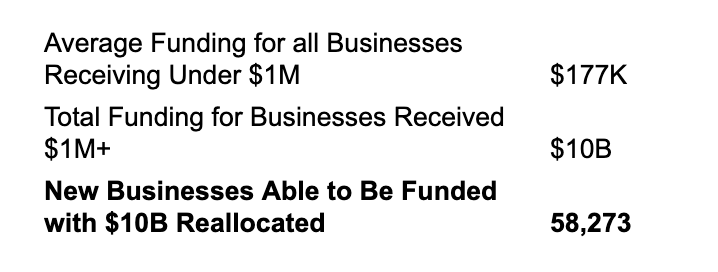

50% More Businesses Could Have Been Funded with a $1M Cap

Here's what could have happened if the American Rescue Plan limited restaurants to $1M grants through the Restaurant Revitalization Fund: 58,273 more restaurants would have been able to get funded.

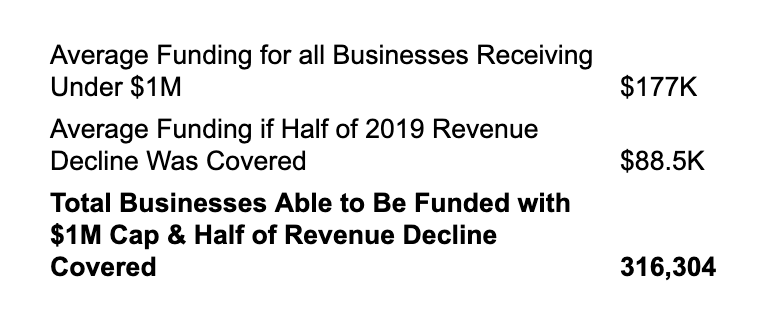

This assumes taking the existing amount of funding that was $1M+ ($10B) and dividing it by the average amount of businesses receiving under $1M ($177K) — getting a total of 58,273.

300% More Businesses Could Have Been Funded with Half the Grant Amounts

What if the American Rescue Plan said it would cover half of the revenue decline restaurants and food businesses experienced in 2019? The relief bill could have assumed the benefit of other programs — such as unemployment for laid of workers, commercial property owners working out payment plans, and/or lower operational and fixed costs for the businesses.

If the legislation specified that half of the lost 2019 revenue could be covered with the RRF grant, that's over 300,000 food, drink, and restaurant businesses that would have received business changing funding — nearly 1/3rd of all restaurants in the US.

Conclusion: $28 Billion For Restaurants Could Have Been Spent Significantly Wiser

Hundreds of thousands of restaurants and food and beverage businesses across the U.S. have temporarily or permanently closed — or are struggling to survive. While the food and drink industry was particularly hard hit due to lockdowns, it was far from alone. Millions of other businesses have relied on other SBA programs, such as the EIDL loan program. The $28.6 billion specifically allocated to helping restaurants, unfortunately, did not go nearly far enough to helping businesses in need.

While 101,000 businesses received funding through the RRF, 176,000 eligible applicants did not receive anything. In the rushed approval of the American Rescue Plan in March 2021, not every policy implication could have been considered, but a little more foresight would have gone a long way. With a $1M grant cap, 50% more businesses could have been funded; with a $500K grant cap, 100% more businesses could have been funded; with a 50% lost revenue replacement and a $1M cap, over 300K businesses could have been funded through this program. Search all RRF grant recipients here.