Is a Business Loan or Line of Credit Better For My Business?

Two of the most common financing options for small businesses are term loans and lines of credit. They both provide access to funding - but which one is better for your business needs?

Below, we break down each option, including the pros and cons, how they work in 2025, and when one might be better than the other.

Here are some related posts:

- How Businesses Can establish Credit in 7 Simple Steps

- 5 Best Business Credit Cards for Small Business Owners

What Is a Term Loan?

A term provides a lump sum of money upfront, which is repaid in fixed installments over a set period, typically with a fixed interest rate. The "term" refers to the repayment length.

Term loans can be used for large purchases like equipment, inventory, hiring, or expansion. Many businesses choose them for their predictability and longer repayment terms.

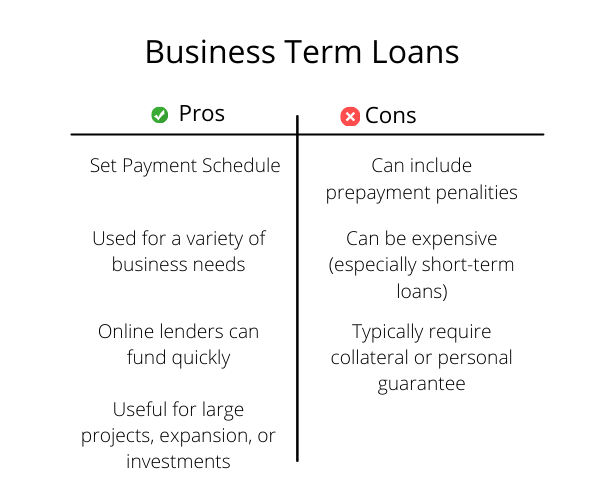

Pros and Cons of a Business Term Loan

Some of the positive aspects of a term loan include the following: a set payment schedule (same payment amount every month until the loan is paid off), term-loans from online institutions can fund quickly, and term loans can be good options for large projects or expansions.

Some of the negative aspects of a term loan include the following: prepayment penalties (being charged a penalty for paying the loan off early), short-term loans can have higher interest rates, and they often require collateral or a personal guarantee.

What Is a Business Line of Credit?

A line of credit works more like a credit card. You're approved for a set amount, and you can borrow from it as needed - only paying interest on what you use. As you repay what you've borrowed, your available credit replenishes.

Lines of credit offer flexibility and can be used for ongoing or unexpected expenses. Most must be repaid within 12–18 months, but many lenders allow renewals if your account stays in good standing.

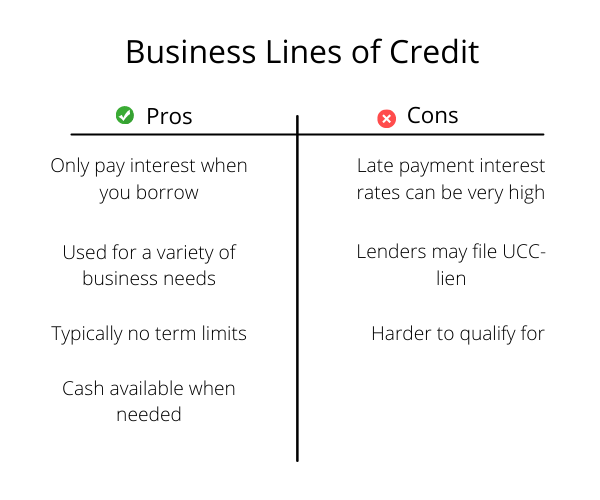

Pros and Cons of a Line of Credit

Some of the positive aspects of a line of credit include only paying interest when you borrow and for the amount that you borrow, having extra cash available when you need it, and they typically don't have term limits.

Some of the negative aspects include being harder to qualify for, having very high interest rates for missed payments, and lenders may file a UCC-lien as collateral.

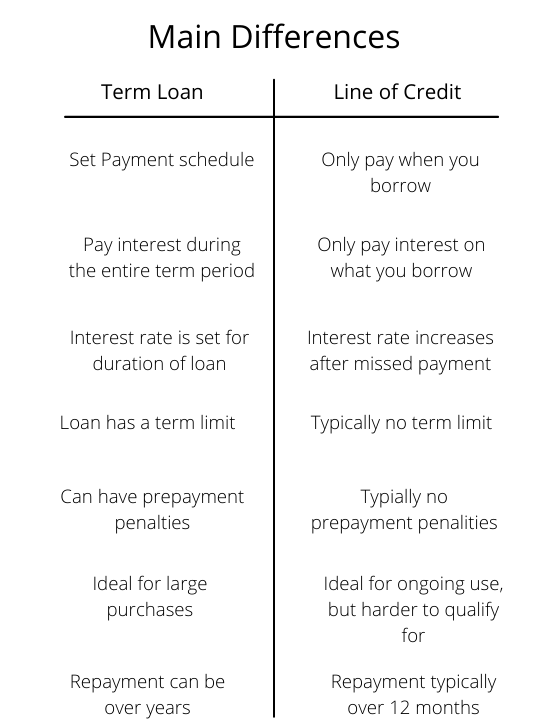

What Are The Major Differences?

First, term loans have a set interest rate, whereas the interest rate on lines of credit can increase dramatically after missed payment, similar to credit card interest rates.

Second, with lines of credit, you only pay interest on the amount you borrow, whereas, with a loan, you pay interest on the entire loan amount throughout your term period.

Thirdly, with a business line of credit, you can pay it off whenever and draw from it again. With term loans, there are often prepayment penalties if you pay off the loan sooner than the term agreement.

Lastly, many consider loans to be better for expenses with known amounts that will occur in a specific time-frame. Lines of credit are often considered better if you think you'll have several smaller expenses over time.

Which One Is Better For Your Business?

After reading about term loans and business lines of credit, you may have already decided which one is better for your business. If not, here are some more pointers.

A term loan may be preferable if:

- You do not want on-going credit availability

- You want one large lump sum of money

- You know how much you need

- You need funding quickly

- You need more than 12-18 months to pay off the loan

A line of credit may be preferable if:

- You will have several smaller expenses arising over time

- You want access to capital whenever you need it

- You want to have a financial safety-net in place at all times

- You want to be able to re-use the funding

- You will be able to pay your credit balance within 12 months

Final Thoughts

Both business term loans and lines of credit can help you grow or stabilize your business. The best option depends on how and when you need to use the funds.

Term loans are ideal for large, fixed costs with predictable timelines.

Lines of credit are best for managing cash flow, handling surprise expenses, or covering short-term needs.

BlueVine and Funding Circle continue to be top online options in 2025, offering fast approvals and flexible packages.

Get Funding Help for Your Business

Need help deciding between a term loan and a line of credit? We can help you assess your options and get funding-ready. Whether you’re applying for grants, SBA loans, or business financing, our team is here to support you.