How to Start a Business: Your Step-by-Step Guide

In 2021 the United States saw phenomenal growth in small business creation — many minority and women-owned. According to a January 2022 report, the U.S. Census Bureau accepted 5.4 million new business applications – surpassing the 2020 record by a million.

If you’re ready to take your unique skill, product, or service to the marketplace, here’s some proven advice on how to bring your ideas to reality. We’ll guide you through the critical steps of starting your business, obtaining licensing or permits, insuring your enterprise, managing your business finances – and lastly, where to look for small business funding.

In This Article:

- Do Your Market Research

- Choose a Business Model

- Write a Business Plan

- Choose a Name, Entity Type, and Register Your Business

- Obtain a Physical Address and Open a Bank Account

- Get Your Employer Identification Number (EIN)

- Secure Permits or Licenses

- Insure Your Business

- Hire a Reputable Bookkeeping Firm

- Fund Your Business

Do Your Market Research

What’s your “why” for starting a business? How will you differentiate your product or service from others? What can you do better than the rest? You should answer all of these questions (and others) before embarking on your entrepreneurial adventure, and that's where market research comes into play.

Market research requires an understanding of economic trends, consumer behavior, demographics, and other analyses to support your business idea – or send you back to the drawing board. The Small Business Association (SBA) offers a comprehensive list of small business market research tools to help with this.

Understanding the market conditions for any nascent business is crucial. Take the time to thoroughly research your market to gain invaluable insight into its potential – or limitations. Why? Understanding your customer is key to your next steps. Here are some other key questions you should consider when starting your business:

- Demand. What’s the demand for your product or service?

- Location. Where are your customers? Are they a local or global audience?

- Market size. How many people are interested in your offering?

- Price. What are consumers willing to pay for a similar product?

- Saturation. Are there similar offerings available? How does yours differ?

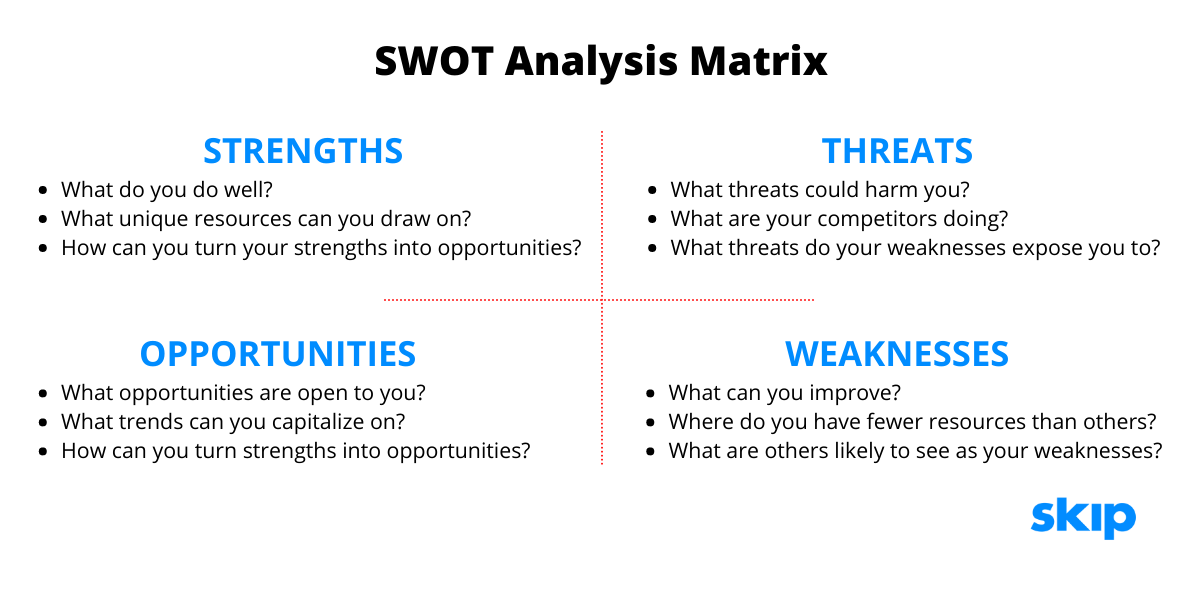

Another way to analyze the viability of your small business (and prepare for the competition) is to use a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) approach. This diagramming exercise can help you make important decisions, like selecting the ideal location for your business, setting competitive pricing strategies, or exposing weaknesses – as well as opportunities.

Choose a Business Model

There’s no shortage of the types of business to start; however, it’s important to understand how you will operate your business — and how you plan to make a profit. Here are a few popular examples of the different types of business models.

- Affiliate marketing. Generates commissions/revenue for click-throughs (CTs) or actual sales for promoting the affiliate’s goods or services.

- Consultancy. A nutritionist, executive coach, financial advisor, or other individuals with highly specialized, and sometimes licensed skills can excel at being consultants.

- Direct-to-consumers. In this model, businesses sell their products directly to the consumers or customers — think retail, restaurants, and the like.

- eCommerce. Revenues are generated by selling physical products through the internet. Sites like Shopify have made starting an eCommerce business exceedingly easy.

- Freelance. Freelancers are individuals who provide a specific set of immediate or ongoing skills to businesses and individuals, e.g., graphic designers, writers, photographers, etc.

- Software as a Service (SaaS). A SaaS business generates recurring revenues from client subscribers who pay to use the software, e.g., MailChimp, Zoom, etc.

Write a Business Plan

Now that you’ve honed in on a credible business idea and determined your business model, you’ll want to write a business plan to clarify your goals and organize your thoughts into actionable steps. Moreover, if you plan on seeking funding, your business plan can help you present yourself as more creditworthy. Your business plan should contain the following:

- Executive Summary. It gives the reader a snapshot of your business and an understanding of your business's mission and goals.

- Target Audience/Market Defined. You need to explain in detail the total number of potential customers, the customers you intend to target within the market, who your competition is, and how you're going to differ from them.

- SWOT Analysis. The SWOT analysis shows that you’ve explored all angles of your business and understand the risks and rewards.

- Marketing Plan. This is how you’ll describe your approach to promoting, branding, and marketing your business.

- Financial Plan and Projections. An explanation of how you plan to pay to get the business started, how you’ll generate revenue, and a listing of your business’s costs.

- Exit Strategy. You will eventually exit a business, knowing how you’ll leave the business helps plan for the future.

Choose a Name, Entity Type, and Register Your Business

Now that you know the type of business you’re starting, the next step is naming your enterprise and registering it as a legal entity. Your business name must be unique and distinctive from all other businesses in the state you register in.

Check your Secretary of State’s websites for name search tools, and naming guidelines, as well as online business registration portals to simplify the process. Consider looking for a matching business domain name when selecting a name for your business.

Before you can legally begin operating your business, you must register your business entity at the state level, and sometimes at the regional/local level. Ensure you know the regulations regarding your business entity wherever you set up shop. Types of business entities include:

- Sole Proprietorship. The simplest and least expensive business to establish.

- Limited Liability Company (LLC). A hybrid business entity that combines the simplicity of a Sole Proprietorship with the liability protections and tax benefits afforded Corporations.

- Corporation. A Corporation generally consists of a group of Shareholders who remain separate from the business for taxation and liability purposes.

- Partnership. A Partnership is a business relationship between two or more people. Each partner contributes—and shares in the profit, risk, liability, and losses.

Obtain a Physical Address and Open a Bank Account

You’ll need a physical address when you register your business entity, and for opening a business banking account. This cannot be a P.O. Box. Home-based businesses should consider a mailbox rental at a UPS store or other local mail services that allow the use of their physical address.

Opening a business bank account is slightly more difficult than opening a personal bank account. Any business, regardless of its type, is required to provide a standard set of documents based on the business entity. Here’s what you’ll need to open a business bank account based on your business entity type.

Get Your Employer Identification Number (EIN)

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number (FTIN), acts much like an individual's Social Security Number (SSN) for business purposes. You cannot reuse an existing EIN for your new venture. Apply for your EIN online.

Secure Permits or Licenses

Depending on your business type, you may need special licenses or permits to operate legally. Understand what licenses or permits you’ll need. Here are just a few examples of federal and state business licenses you may be required to obtain before operating your business:

- Agriculture permits

- Alcohol permits/liquor licenses

- Firearms or explosive permits

- Maritime transportation permits

- Real estate licenses

Insure Your Business

Having insurance safeguards against lawsuits, liability, and other types of damages. Every responsible owner should consider insuring their business. Consider your business industry, business assets, and potential risk when choosing insurance.

In our ultimate guide to selecting business insurance, we break down 13 different types of business insurance and explain who could benefit from each type. Remember, it's always a good idea to speak with an insurance broker before purchasing a policy.

Hire a Reputable Bookkeeping Firm

When starting a small business, every penny counts. And while many business owners assume this role, the job of business accounting is best left to the professionals. Whether you own a large enterprise or are self-employed, there's an option for you. Here are a few bookkeeping service providers for your consideration:

- Bench Accounting is a powerful web-based bookkeeping service. They offer monthly bookkeeping and annual financial statements, unlimited support for business owners like you, tax assistance.

- QuickBooks is a trusted software for millions of businesses. There are numerous different products to choose from, making it a very versatile program. QuickBooks Online, which is used by over 7 million businesses, offers you four different packages to choose from.

- Wave has quickly become a popular option among small business owners due to its free and low-cost software. They offer personalized assistance and guidance from their team of bookkeepers so you can focus on your business.

Fund Your Business

Arguably one of the most important aspects of starting a business is adequately funding your business. Whether it be through crowdfunding, investors, business loans, lines of credit, or a mixture of all of them, you need funding for your business.

Funding Circle and Fora Financial are online lenders that offer a variety of loan options, while BlueVine and Fundbox offer competitive lines of credit. Online lenders are often able to fund business loans quicker than traditional lenders can, which makes them attractive options for businesses that need capital fast.

Get Help With Your Business

Do you need help forming or funding your business? Skip can help with your formation, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.