How To Get $10K Grants For Your Small Business

Over 3 million grants are still available for entrepreneurs and small business owners across the country through the SBA's Targeted EIDL Advance programs. They are still available but they may disappear in the near future. If your business needs capital and qualifies, it's important to apply now. Here's how to apply to and why the funds may soon disappear.

📌 Pro-tip: Have questions about EIDL grants or loans, including reconsideration or getting approved? Get ongoing personalized funding help from our team. There are over 2,000 on the waiting list to get help. You can skip the wait list completely with this invite link, exclusive to our readers.

Who Can Apply for the Targeted EIDL Advance?

Qualifying businesses can apply for up to $15,000 in grant funding (called advances) through the Targeted EIDL and Supplemental Advances. In order to qualify for the Targeted EIDL grant of $10K, businesses must meet the following criteria:

- Be located in a low-income area. In order to qualify, businesses must be located in a low-income area as determined by the SBA. Businesses can use the SBA's mapping tool to identify their business and determine if they are located in a qualifying area.

- Demonstrate more than a 30% loss of revenue. Businesses must be able to demonstrate a 30% reduction in revenue over an eight-week period anytime after March 1, 2020.

- Have 300 employees or fewer.

📌 Join the quarter-million other businesses and use the Skip app to check if you qualify for one or both Targeted Advances.

To qualify for the additional $5,000 Supplemental Advance, businesses must be located in a low-income area, have a 50% reduction in their revenue, and have 10 employees or fewer.

How Do You Apply for the Targeted EIDL Advance?

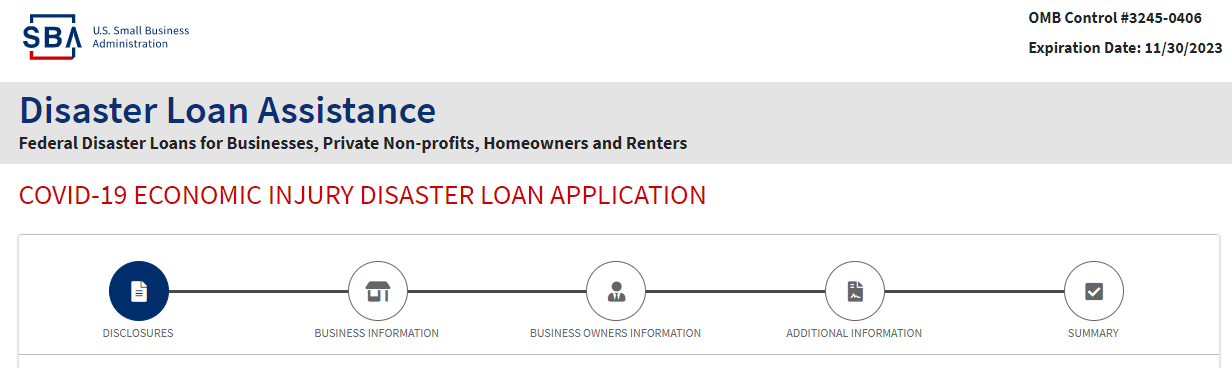

In order to receive the Targeted EIDL advance, you must apply for the Covid-19 EIDL program. The application takes around ten minutes to complete, but it's critical to fill it out accurately to minimize potential delays to your funding. There are four main sections to the application: Disclosures and eligibility requirements, business information, business owner information, and additional information.

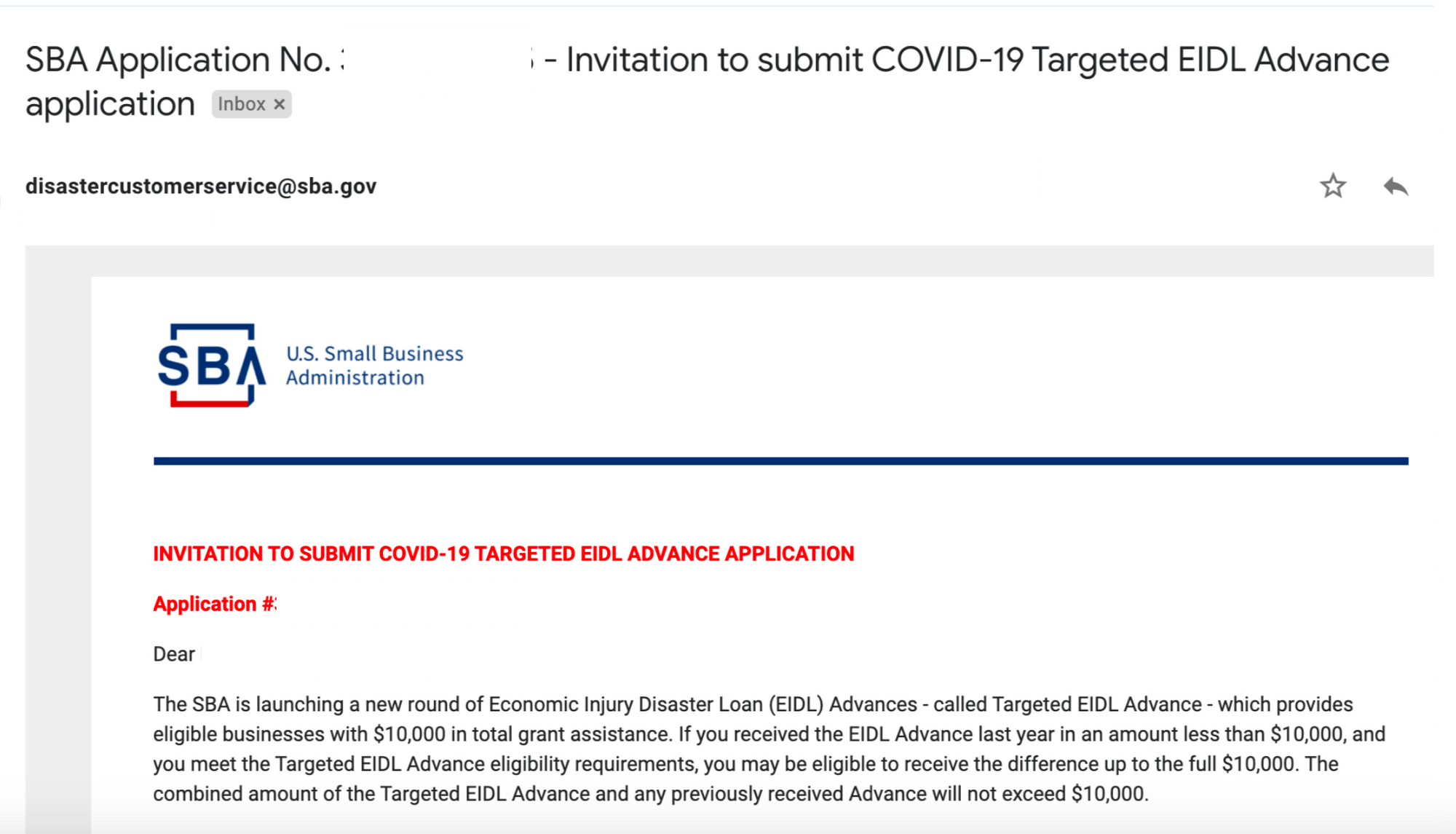

You do not need to accept an EIDL loan to qualify for the advances. When you apply for the Covid Eidl program, the SBA will automatically determine if you qualify for the Targeted and Supplemental Advances. The SBA will email you and invite you to apply. Below is an example of what the email from the official sba.gov email address looks like:

Why Will the Targeted EIDL Advance Disappear?

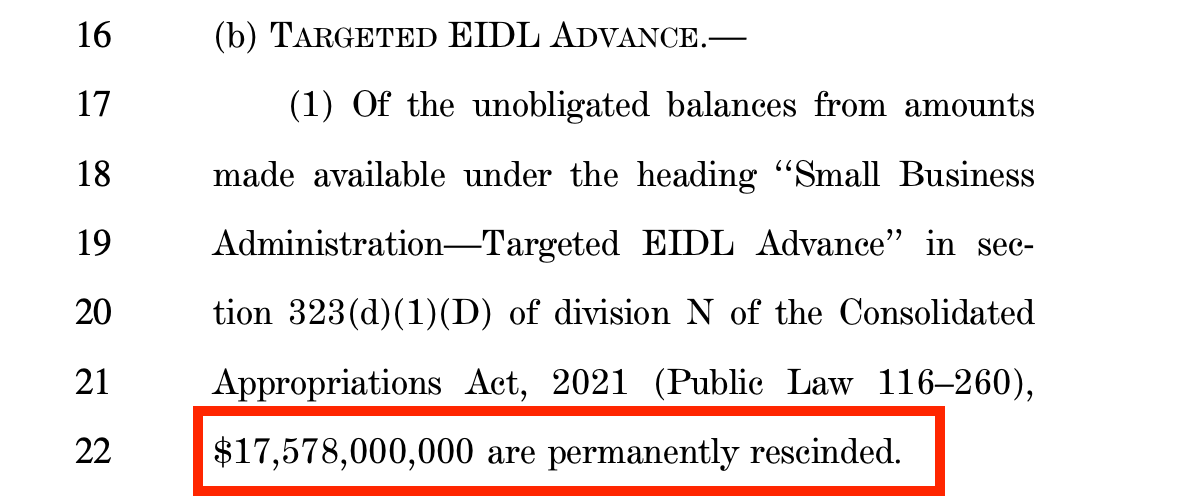

At the beginning of August, the Senate passed the $1 billion infrastructure bill. A provision in this bill strips existing funding away from the Targeted EIDL Advance fund to reallocate it to the funding of the infrastructure bill.

Under Section 90007 of the bill, there is a "rescission of unobligated balances" from the SBA's disaster loans, which includes the Covid EIDL program.

Included in this section is the permanent rescission of over $17 billion from the Targeted EIDL Advance program.

Speak of the House, Nancy Pelosi, agreed to hold a vote for the infrastructure bill on September 27th. Members of the House have mentioned that they may miss the September 27th deadline, but it is still a possibility. That means that funding for the Targeted EIDL Advances may be reallocated in the very near future.

Apply for the Targeted EIDL Advance Before It's Too Late

Millions of small businesses have not applied for the SBA Covid EIDL program and the Targeted EIDL Advance. Time may be quickly running out for businesses to take advantage of these grants. If you qualify, or know someone that does, now is the time to apply. If you have other questions about the EIDL program, we answered 10 of the most common EIDL questions.

📌 Pro-tip: Have questions about EIDL loans or grants, including reconsideration or getting approved? Get ongoing personalized funding help from our team. There are over 2,000 on the waiting list to get help. You can skip the wait list completely with this invite link, exclusive to our readers.