Fora Financial vs. Funding Circle: Comparing Different Small Business Loans

If you’re a small business owner looking for fast and convenient access to working capital, reputable digital lending institutions are looking to help you achieve your goals. In this article, we compare two leaders in the online lending space, Fora Financial and Funding Circle.

The following highlights and defines each of their offerings, how they differ, and how they might benefit your small business. We’ll go over the pros and cons of these loan types, their terms, and what you’ll need when applying online. Lastly, having a bad credit score doesn’t necessarily preclude you from obtaining a small business loan. There are options for you too.

What Loan Types Does Fora Financial and Funding Circle Have?

With the promise of fast approval and even faster funding, Fora Financial and Funding Circle have gained a foothold in the burgeoning online lending space.

These online lenders offer a variety of loan products—new and traditional—to suit the changing needs of small businesses. They both offer a simple online application process, the convenience of rapid approval, fast access to funding, and the flexibility to set terms to suit your immediate, or long-term needs. Here’s how they differ.

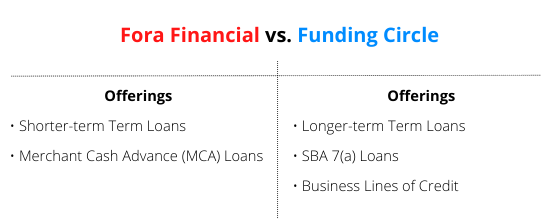

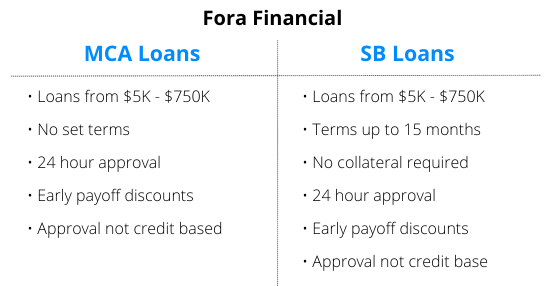

Fora Financial keeps it fairly simple with two product offerings—short, to medium-term small business term loans, and merchant cash advance (MCA) loans. Funding Circle deals in more traditional small business loans—like longer-term term loans, SBA government loans, and business lines of credit.

Do you have funding questions about your business, such as EIDL applications, SBA loans, or other business financing questions? Get ongoing personalized funding help from our team.

How are Term Loans, SBA 7(a) Loans, and Business Lines of Credit Defined?

Fora Financial has a well-defined focus in smaller funding amounts and MCA loans. Funding Circle offers more traditional loan products, such as 7(a) loans and other term loans. Below are explanations of the different types of loan products.

What is a SBA 7(a) Loan?

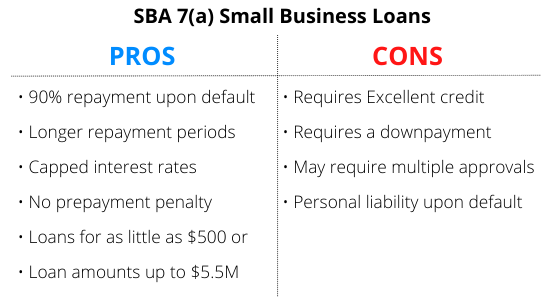

An SBA 7(a) loan is more of a partnership with lenders by way of a Government-backed loan guarantee. With an SBA loan, lenders are guaranteed up to 90% repayment by the SBA should a small business default. A 7(a) loan provides greater access to capital at lower interest rates and with better repayments terms.

With their attractive guarantees, 7(a) loans are ideal for small businesses who need access to as little as $500, or as much as $5.5M. It is designed for small businesses that might otherwise be unable to access capital.

There are plenty of good reasons to apply for a 7(a) loan, but there are downsides too. A small business applying for an SBA loan might be required to provide a down payment or other collateral to secure the loan—and you’ll need fairly good credit.

Moreover, applying for SBA loans can be confusing and time-consuming. When you’re starting a small business, you may not have a lot of extra time. This is where Funding Circle adds value—by simplifying the process and shortening the approval time.

What are Small Business Term Loans?

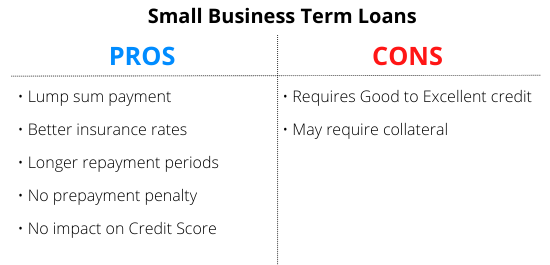

A term loan can be as short as 12 months or as long as 25 years. Like a mortgage, term loans operate on structured repayment timelines and amounts and most likely will provide better borrowing terms.

What is a Small Business Line of Credit?

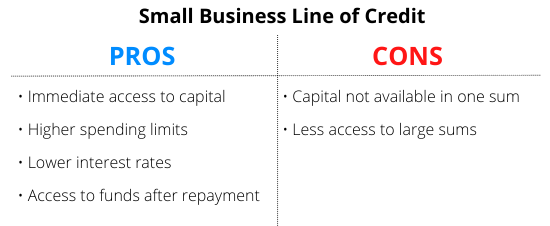

A small business line of credit is similar to a short-term loan. It is designed to help meet the immediate needs of a business’s day-to-day operations, like paying vendors, or covering payroll, and provides periodic access to a set amount of cash.

A line of credit is like a credit card—with better terms. You only pay interest on borrowed money. A small business line of credit allows you to re-borrow any repaid portion, up to your credit limit and until the draw period concludes.

Funding Circle’s small business lines of credit offer flexible access to cash when needed instead of in one lump sum.

What is a Merchant Cash Advance (MCA) Loan?

Like most small business loans, a merchant cash advance loan is paid in a lump sum to use for whatever your business might need—payroll, taxes, facility improvement, or purchasing specialized equipment.

They differ from other small business loans, or term loans, in that their repayment schedule is based upon a percentage of monthly credit card earnings. A term loan usually has capped interest rates, repayment amounts, and varying periods for repayment.

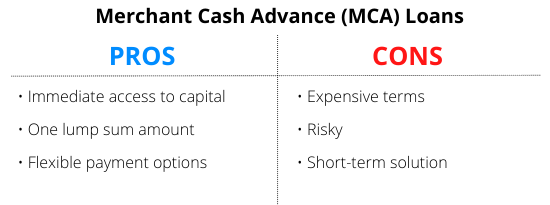

The upside—MCA loans provide rapid access to working capital, and the flexibility to adjust payment amounts.

Such easy access to immediate working capital makes MCAs more expensive than other types of small business loans. They may also add-risk, and only offer a short-term solution for your business.

Fora Financial's MCAs can be especially advantageous for a variety of business types—restaurants, construction firms, or hospitality industry companies—who experience predictable, and sometimes unpredictable, slow seasons.

How Does My Credit Score Affect My Ability to Get a Small Business Loan?

Your credit score can be one of the most important factors when applying for a loan. It determines your eligibility to get a loan and the interest rates you’ll pay if you’re approved for a loan. The better the score, the better the terms.

Additionally, many federal programs, like the SBA's 7(a) loans, factor in credit when making approvals. That’s not to say you won’t qualify if you have less than stellar credit. It means you might be paying more for your loans.

What Do I Need to Apply for a Small Business Loan with Fora Financial or Funding Circle?

To begin the loan application process with either of these lenders, come prepared with personal and business information, credit scores, financial statements, and business structure documents.

Requirements for initiating and qualifying for a loan vary from lender to lender and can vary based on the loan amount requested. Generally, the application processes are similar. Be prepared to provide the following:

- Purpose of the loan

- Personal and Business Credit Scores

- Annual revenue or monthly sales receipts

- Personal and business bank statements

- Tax returns

- Credit reports (pulled by institution)

- Financial statements

- Cash flow

- Business plan with financial projections

- Proof of collateral

Which Online Lender is Right for My Small Business Loan?

Each of these online lenders fills a specific niche in small businesses lending. If you're looking for predictability, long-term repayment options, and better interest rates for small business loans, for up to $5.5M, Funding Circle's traditional loan products could be a better fit.

If your business needs fast access to up to $500k to make it through a seasonal downturn, complete a project, or hire temporary staff, Fora Financial's short-term loans and MCA loans are right for you.

What’s the Right Loan Type for My Business?

Once you have a realistic set of objectives and a clear understanding of your business goals, you’ll be able to base your decision on which type of small business loan, and lender, is right for you. With a plethora of lending options and historically low interest rates, now’s a terrific time to start a small business.

Funding Circle and Fora Financial are online lenders that offer a variety of options. Online lenders are often able to fund business loans quicker than local banks can, which makes them attractive options for businesses who need capital fast.

Need Help With Business Funding?

Do you have other questions about your business, such as EIDL applications, SBA loans, or other business funding questions? Get ongoing personalized funding help from our team. Join Skip Premium today and get 1-1 support.