New Survey: EIDL Funding Kept 60% of Recipients in Business

Small businesses were greatly affected by the Covid-19 pandemic, and many continue to struggle to this day. Our survey of over 1K small businesses revealed several eye-opening realities. One of the most jarring — 60% of businesses reported that they would be out of business today if they did not receive funding from the SBA's Economic Injury Disaster Loan (EIDL) program.

Our goal was to conduct the largest survey of EIDL recipients to date and understand the impact it had — and continues to have — on small businesses across America. Here are the results.

84% of Businesses Need More Funding

Small businesses are eligible to receive up to $2M through the EIDL program, but our survey results indicate the average loan is $142K. 53% of respondents are waiting for more EIDL funding – an average of $199K more.

Additionally, 84% of business owners are seeking more funding – EIDL and non-EIDL. Federal programs like the EIDL, Paycheck Protection Program (PPP), Restaurant Revitalization Fund (RRF), and others indeed helped millions of small businesses through the pandemic, but more assistance is required.

📌Pro tip: Need more funding? Join Skip Premium today and get 1-1 support for your business.

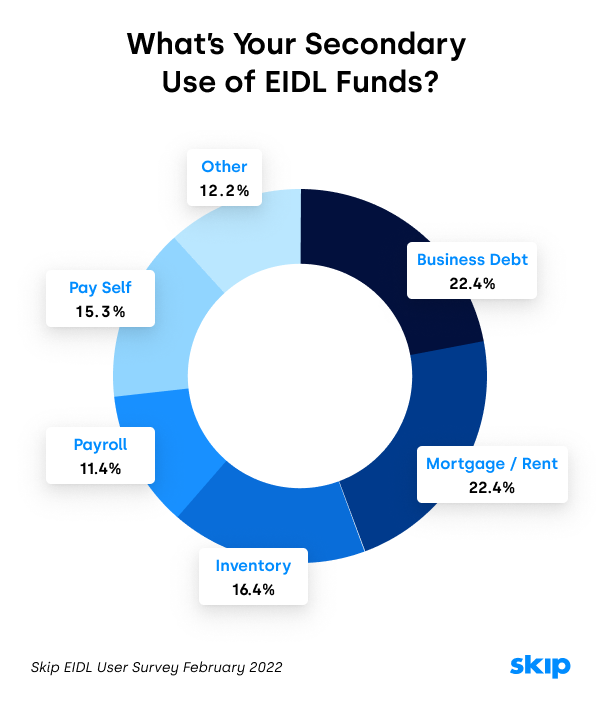

Business Debt, Payroll, and Mortgage/Rent Were Most Common Uses of EIDL Funds

In September of 2021, the SBA modified the EIDL program — allowing businesses to use their EIDL funds to pay off non-federal debt and to make payments on other federal debt.

According to our survey, that's the primary way businesses used their EIDL funds. 28.7% reported paying off business debt was the primary use of funds, and 26.3% reported payroll was the primary use of funds.

Businesses were also asked about their secondary use of EIDL funds. 22.4% stated paying for mortgage or rent was the secondary priority. An equal percent stated paying off business debt was the secondary use of EIDL funds.

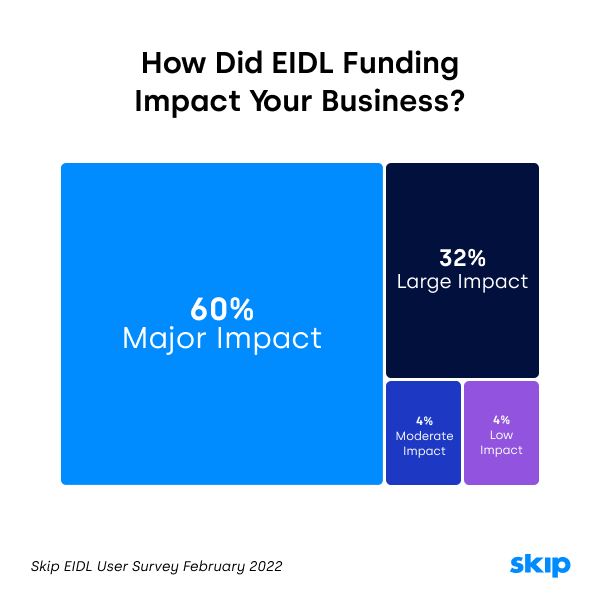

60% of EIDL Recipients Would Have Closed Without Funding

Respondents were asked to rate the impact of the EIDL program on their businesses, from major impact to low impact. Here are the definitions we used in the survey.

- Major impact. Would not be in business today without it [EIDL funds]

- Large impact. May or may not be in business today without it

- Moderate impact. Business would have been ok without it

- Low impact. I simply took advantage of the low-interest rate

92% of recipients answered that the EIDL program had a major or large impact on their business — 60% stated that it had a major impact.

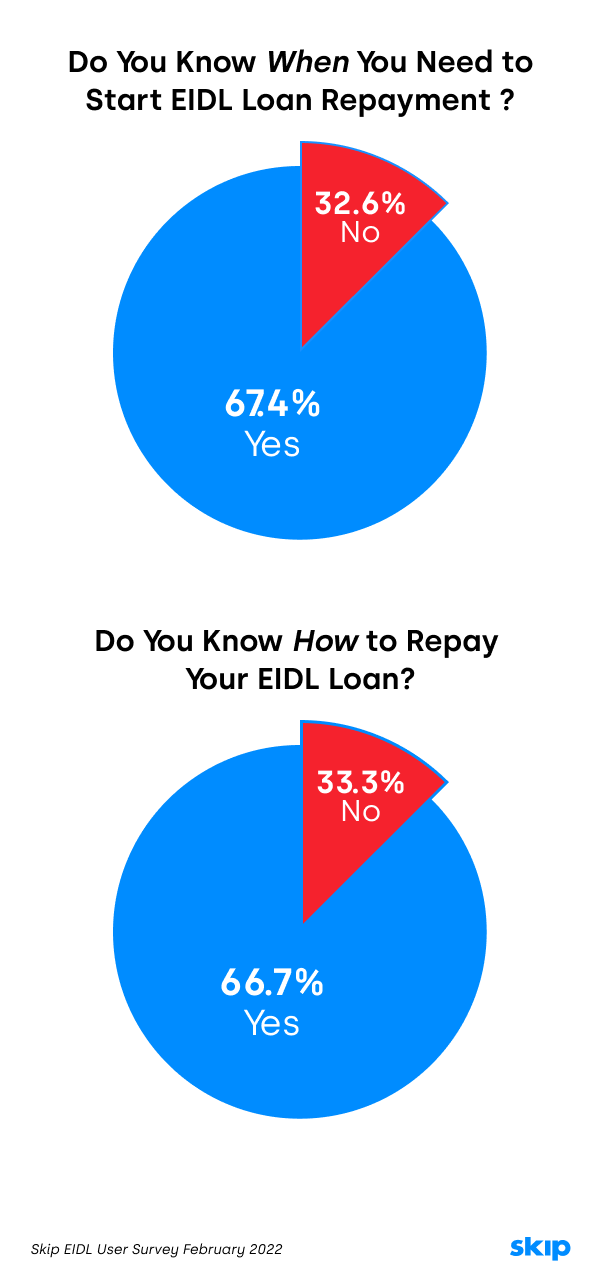

One-Third of Business Owners Do Not Know How or When to Repay Their Loan

When the EIDL program launched, the maximum loan amount was $150K. It was increased to $500K in April of 2021 and increased again to $2M in September of 2021. As a result, many business owners are unsure when their EIDL payments begin — and even how to make their payments.

81% of Respondents are Optimistic About the Future of Their Business

81% of business owners that received EIDL funding are optimistic about the future of their business. Of the 81% that are optimistic, 58% also stated that the EIDL program had a major impact on their business (would not be in business today without EIDL funds).

Additionally, 79% of respondents that said the EIDL program had a major impact on their business also stated that they were optimistic about the future. This seems to underscore the significant impact the EIDL program had on the sustainability of small businesses.

Skip Has Helped Businesses Get Over $1B in Funding

Skip's mission is to "create a world with no more red tape." We have made it our mission to help as many businesses access EIDL funding — and other funding sources — as possible and have helped small businesses collectively secure over $1B in funding.

Do you need help with your EIDL application or getting funding for your business? Skip can help your business with EIDL, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

Skip's EIDL Use Survey received 1,141 responses and included businesses from 47 states, Guam, and Puerto Rico. 44% were sole proprietors, 30% were LLCs, followed by corporations, independent contractors, and partnerships. 65% reported being a minority-owned business, 61% reported being a women-owned business, and 7% reported being a veteran-owned business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.