Do I Need an EIN For My LLC?

A Limited Liability Company (LLC) is a very flexible business entity. How you form your LLC and the number of owners within your LLC will determine if you need to apply for an EIN. In this article, we define what an EIN is, discuss the types of LLCs, and help you decide if you need to get an EIN or not.

What Is An EIN?

An Employer Identification Number (EIN), also referred to as a Federal Tax Identification Number (FTIN), is a number that is assigned to each business. Much like a Social Security Number (SSN) for an individual, an EIN identifies a specific business.

The Internal Revenue Service (IRS) as well as other financial institutions, use your EIN to differentiate your business from other businesses that have similar names. Applying for an EIN is free and easy to do on the IRS website, but do you need one for your LLC? First, it's important to understand the different types of LLCs.

What are the Different Types of LLCs?

Generally speaking, there are either single-member LLCs or multi-member LLCs. Unlike a sole proprietorship, an LLC is considered a different entity and is formed at the state level. LLCs offer a great deal of flexibility when it comes to business management, profit distribution, and how your business is taxed.

When it comes to taxes, the IRS's default is to treat an LLC as a partnership–if it has more than one member (owner)–and treat a single-member LLC as a sole proprietorship. In other words, the IRS will not tax your LLC as a corporation unless you file Form 8832 and elect to be treated as a corporation.

A single-member LLC, often called a "disregarded entity," will have its financial activities accounted for on the owner's federal tax return. This means that all business profits and losses will be reported on your personal tax return. For excise tax and employment tax purposes, the LLC will still be considered a separate entity.

Why does all this matter? The need for an EIN–or not–is based on your business's tax status with the IRS.

Does My LLC Need an EIN?

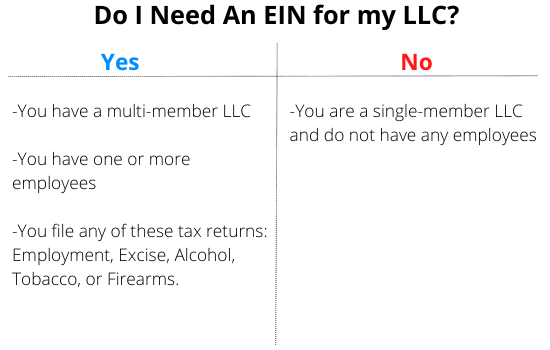

In short, all multi-member LLCs – those taxed as partnerships or corporations by the IRS – must have an EIN. Because there is more than one owner, the IRS cannot consider the business a "disregarded entity" and thereby can't treat it like a sole proprietorship.

Single-member LLCs, on the other hand, have a choice. Since there is only one owner, it is considered a "disregarded entity" and can be treated like a sole proprietorship. You can choose between using your SSN or getting an EIN. The one caveat being if you decide to hire an employee, you must get an EIN.

There are other situations when you are required to have an EIN. You must apply for an EIN if you have employees, have a multi-member LLC, or file any of these tax returns: Employment, Excise, Alcohol, Tobacco, or Firearms.

Should I Get an EIN?

If you are a single-member LLC and are not required to obtain an EIN, there are many reasons why you may still want to get one. First, many banks require an EIN if you want to open a business bank account. Having a separate account for your business keeps your finances tidy and helps preserve your liability protection.

Second, many companies and vendors require businesses to have an EIN. Depending on your industry and the vendors in your area, you may need to get one to conduct business.

How do I Apply For an EIN?

Applying for an EIN is simple–and free–and can be done in one of four ways: online, by fax, by mail, and by phone.

- Apply online: Applying online is the fastest way to obtain an EIN. Your information is validated and your EIN is produced immediately

- Apply by fax: If you prefer not to use the IRS website, you can apply by fax. Simply download form SS-4, fill it out accurately, and fax it to (855) 641-6935.

- Apply by mail: If you don't have access to the internet or a fax machine, you can mail form SS-4 to Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999. Allow up to 4 weeks for your application to be processed.

- Apply by phone-International Applicants: International applicants who are authorized to receive an EIN can call 267-941-1099 Monday through Friday from 6 a.m. to 11 p.m. est.

Get Ongoing Help For Your Business

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.