Breaking: EIDL Loan Increase Total Approval Numbers

Since the pandemic began, around 10 million small business owners around the US have benefited from the Small Business Administration's (SBA) Economic Injury and Disaster Loan (EIDL) program.

In fact, under the Biden Administration, the new head of the SBA, Isabel Guzman, has made a number of policy changes to increase the amount of funding small business can receive - in particular for EIDL loans.

Millions of small business owners are waiting for EIDL loan increases or EIDL grants. This report goes over the latest numbers on who's been approved, and how much progress the SBA is making.

📌 Pro-tip: We've done a pre-populated email template you can send to the SBA to check on your EIDL loan increase status under our Skip Plus grants tracker.

How Many EIDL Loan Increases Have Been Approved?

On April 6, 2021, the SBA started processing EIDL loans and EIDL loan increases requested, based on the new policy: a loan equivalent to 24 months of working capital with a $500,000 limit. Previously, loans were based on 6 months of working capital with a $150,000 limit.

According to our sources, since April, 30,000 EIDL loan increases have been approved for a total amount of $4.5 billion.

In addition, 28,000 new EIDL loans have been approved for a total amount of $4.6 billion. This is an average EIDL loan amount of $168,000, up from the previous average of $54,000.

What's most interesting to see is that EIDL loan increase approvals and new EIDL loan approvals are nearly identical. For folks who've applied this year for EIDL loans, you have an increased chance of a faster approval.

Is the SBA Approving EIDL Loan Increases Faster?

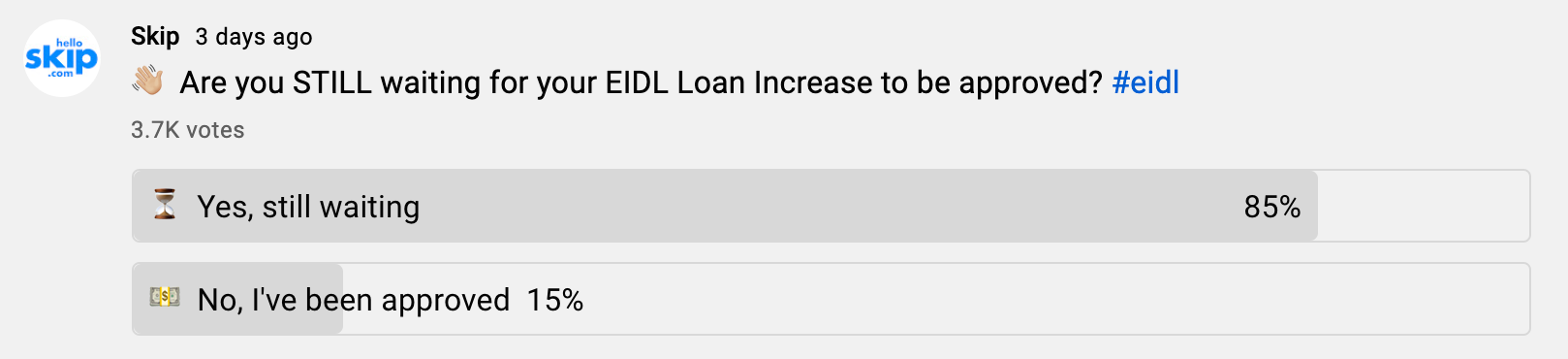

Based on our YouTube surveys, the answer is "sort of." Our poll from 6 weeks ago with over 6,000 votes showed 93% of people still waiting for their EIDL loan increase. Our poll from 3 weeks with over 5,000 votes showed 91% of people still waiting on their EIDL loan increase.

And our poll from 3 days with nearly 4,000 votes shows 85% of people still waiting. From these surveys alone, it appears the SBA may be slightly increasing their pace of EIDL loan increase approvals.

Our letter to the SBA advocated for 3 changes to improve and speed up the EIDL loan and grant approvals process.

When Can You Expect your EIDL Loan Increase to Be Approved?

Despite this progress, it's likely millions of businesses are still waiting for their EIDL loan increase. There have been over 3.8 million EIDL loans approved and distributed since the start of the pandemic — and based on the new rules, all of these businesses are eligible for higher loan amounts.

The SBA has said they are actively working to speed things up, including looking into hiring more loan officers and speeding up how they get or review tax transcripts. In fact, the SBA may be working on an alternative to reviewing IRS tax transcripts which continues to be one of the main bottlenecks.

If you'd like to see past data on who's received EIDL loans or EIDL grants, you can use our EIDL recipient search tool. The data may not have the latest recipient information.

Will the Infrastructure Bill Take Money Away from the EIDL Program?

In Biden's new $1 trillion infrastructure proposal which is being finalized now, part of how they'll pay could be by "redirecting unused state and local coronavirus relief funds". Some of the initial speculation is that this could mean SBA EIDL funding, of which there is hundreds of billions that is unspent.

It seems unlikely that they would take away money for EIDL loan and grant applicants that are already in the queue — however it's possible this may mean the SBA stops accepting new applications. This is all speculation at this point, but it's something to potentially be aware of.

Two recommendations to mitigate this would be to subscribe to our YouTube channel to stay up-to-date as well as consider applying for an EIDL loan if you have not yet.

What are alternatives to EIDL loan and grant programs?

Private and state-level grant programs continue to help tens of thousands of small business owners across the US. In addition, many banks and lenders have also improved their lending capabilities, including offering fairly competitive interest rates. We've cover all of these options on our Skip Plus grants tracker. Join hundreds of thousands by starting a free 2 week trial, and get access to alternative EIDL loan and grant options.